Your email has been sent.

HIGHLIGHTS

- A few blocks away from Broadway's "Open Street"

- Located conveniently near Metro stations, bus line and Grand Central Terminal

- Supported by New York Public Library, MetLife Buildng and more

ALL AVAILABLE SPACE(1)

Display Rental Rate as

- SPACE

- SIZE

- TERM

- RENTAL RATE

- SPACE USE

- CONDITION

- AVAILABLE

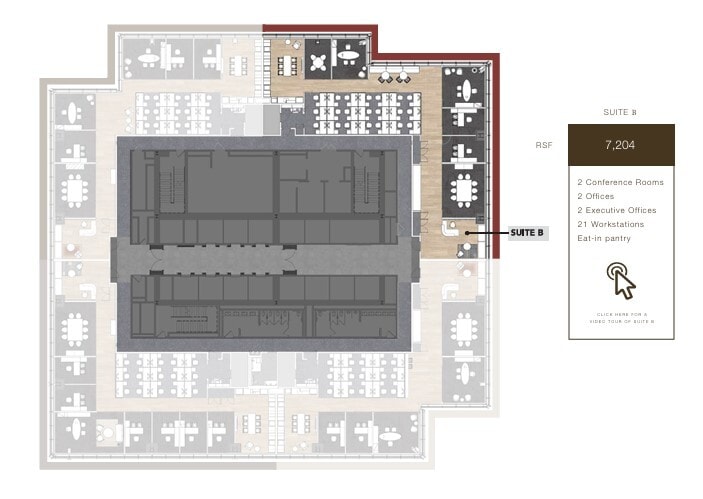

Turn-key ready, fully furnished suite

- Fully Built-Out as Standard Office

- Space is in Excellent Condition

- Mostly Open Floor Plan Layout

| Space | Size | Term | Rental Rate | Space Use | Condition | Available |

| 54th Floor, Ste 5400 | 7,204 SF | Negotiable | Upon Request Upon Request Upon Request Upon Request | Office | Full Build-Out | August 01, 2026 |

54th Floor, Ste 5400

| Size |

| 7,204 SF |

| Term |

| Negotiable |

| Rental Rate |

| Upon Request Upon Request Upon Request Upon Request |

| Space Use |

| Office |

| Condition |

| Full Build-Out |

| Available |

| August 01, 2026 |

54th Floor, Ste 5400

| Size | 7,204 SF |

| Term | Negotiable |

| Rental Rate | Upon Request |

| Space Use | Office |

| Condition | Full Build-Out |

| Available | August 01, 2026 |

Turn-key ready, fully furnished suite

- Fully Built-Out as Standard Office

- Mostly Open Floor Plan Layout

- Space is in Excellent Condition

PROPERTY OVERVIEW

Hines is partnering with SL Green Realty Corp. and NPS to develop One Vanderbilt, a 59-story, 1.6 million-square-foot commercial office tower in Midtown Manhattan between Madison and Vanderbilt Avenues and 42nd and 43rd Streets. Designed by Kohn Pedersen Fox Associates (KPF), the project features a crown that will be visible from across the five boroughs and beyond with a spire that will extend the official height to 1,401 feet above street level. The development will include over 1.5 million square feet of new Class A office space and 104,323 square feet of new retail space. The building will be topped with a 28,000-square-foot observation deck that will occupy floors 57, 58 and 59.

- Bus Line

- Controlled Access

- Conferencing Facility

- Metro/Subway

- Restaurant

- Security System

- Natural Light

- Outdoor Seating

PROPERTY FACTS

SELECT TENANTS

- FLOOR

- TENANT NAME

- INDUSTRY

- Multiple

- TD Bank

- Finance and Insurance

SUSTAINABILITY

SUSTAINABILITY

LEED Certification Developed by the U.S. Green Building Council (USGBC), the Leadership in Energy and Environmental Design (LEED) is a green building certification program focused on the design, construction, operation, and maintenance of green buildings, homes, and neighborhoods, which aims to help building owners and operators be environmentally responsible and use resources efficiently. LEED certification is a globally recognized symbol of sustainability achievement and leadership. To achieve LEED certification, a project earns points by adhering to prerequisites and credits that address carbon, energy, water, waste, transportation, materials, health and indoor environmental quality. Projects go through a verification and review process and are awarded points that correspond to a level of LEED certification: Platinum (80+ points) Gold (60-79 points) Silver (50-59 points) Certified (40-49 points)

Presented by

One Vanderbilt | 1 Vanderbilt Ave

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.