Log In/Sign Up

Your email has been sent.

INVESTMENT HIGHLIGHTS

- 10,000 sf additional office and storage space.

- Great opportunity for Low Income Housing Conversion

- Located in Opportunity Zone.

EXECUTIVE SUMMARY

Drastic Reduction to price as of February 17, 2022 from previously being $4,000,000 to the price above! Located in an Enterprise & Opportunity Zone, Number one busiest street in Nogales ! Was once a historic hotel. Many possibilities!!!!

“The Promise of Opportunity Zones”

May 17, 2025

Introduction

Chairman Paulsen, Ranking Member Heinrich, and members of the committee: it is a pleasure to be with you today.

I am the Co-founder and President of the Economic Innovation Group (EIG), a bipartisan research and advocacy organization. EIG helped to design and champion the Investing in Opportunity Act, legislation authored by Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI). This legislation, which enjoyed broad bipartisan support, was the basis for the Opportunity Zones provision in the Tax Cuts and Jobs Act (TCJA) of 2017.

The Opportunity Zones initiative is the most ambitious federal attempt to boost private investment in low-income areas in a generation, one with the potential to drive billions of dollars in new private investment to struggling communities over the coming decade. Since Opportunity Zones became law, EIG has worked closely with state and local policymakers, community organizations, philanthropies, and leading investors to raise awareness, provide analysis, and gather feedback in support of timely and effective implementation nationwide.

In the testimony that follows, I will:

Highlight key design features of the Opportunity Zones incentive;

Provide an overview and analysis of the state selection process and outcomes;

Underscore what states, cities, and the federal government should do to make Opportunity Zones successful; and,

Address ways to define and measure success.

Key features of the Opportunity Zones incentive

The fundamental purpose of Opportunity Zones is to encourage long-term equity investments in struggling communities. In pursuing this goal, Congress established an incentive framework flexible enough to support a broad array of investments and encourage creative local implementation strategies. The unique structure – and equity focus – of this incentive has the potential to unlock an entirely new category of investors and create an important new asset class of investments. Congress designed Opportunity Zones to complement existing community development programs while incorporating lessons learned from previous place-based efforts. I want to draw particular attention to two of its most important distinguishing features:

First, it is a highly flexible incentive that can be used to fund an array of equity investments in a variety of different sectors. This is critical, because low-income communities have a wide range of needs, and Opportunity Zones at their best will recruit investments in a variety of mutually enforcing enterprises that together improve the equilibrium of the local community. The structural flexibility extends to Opportunity Funds, the intermediaries that raise and deploy capital into Opportunity Zones. These funds can be nimble in responding to market interest and opportunity, thereby widening the aperture of investors who can participate. And, because Opportunity Funds do not need pre-approval for transactions, the cost, complexity, and time needed to deploy capital should be lower than in other programs.

Second, the incentive is nationally scalable. There is no fixed cap on the amount on capital that can be channeled to target communities via Opportunity Funds, nor is there a limit on the number of Opportunity Zones that can receive investments in any given year. This scalability derives from that fact that investors are incented to reinvest their own capital gains without any up-front subsidy or allocation. EIG’s analysis of Federal Reserve data found an estimated $6.1 trillion dollars in unrealized capital gains held by U.S. households and corporations as of the end of 2017. Even a small fraction of these gains reinvested into Opportunity Zones would make it the largest economic development initiative in the country.

Flexibility and scalability are essential ingredients because they unlock the vast creativity and problem-solving potential of communities and the marketplace in ways that would not be possible under a more prescriptive policy framework. Congress and the Administration should do everything possible to preserve and enhance these features as implementation moves forward in the months ahead, including through technical statutory refinements that will help ensure strong uptake among a broad spectrum of investors.

How were Opportunity Zones selected?

Congress gave governors of every state and territory the critical lead role of selecting Opportunity Zones. Under the statute, each governor was allowed nominate up to 25 percent of his or her state’s low-income community census tracts to be designated as areas where the federal tax incentive will apply.

Low-income community census tracts are generally defined as places with poverty rates of at least 20 percent or median family incomes no greater than 80 percent of the surrounding area. Nearly 32,000 tracts meet this definition nationwide, totaling roughly 43 percent of all U.S. census tracts. Thus, governors had to narrow the pool of eligible tracts down to roughly 8,700 selections. In order to offer real-world flexibility in assembling meaningful zones, governors were permitted to substitute up to 5 percent of their nominated tracts with those that met a slightly lower need threshold, as long as the tracts were contiguous with other nominated low-income community tracts. Governors were required to submit their nominations to the U.S. Department of the Treasury by April 20, and we now await the final tranche of certifications by the Secretary to complete the national map.

Congress sought to establish a national standard for Opportunity Zones while allowing local priorities to dictate the target communities. The resulting selection process was in keeping with the federalist spirit of the new law, as states went about identifying priorities, engaging stakeholders, and incorporating additional selection criteria in ways that reflected their unique local characteristics. The core challenge for governors was striking the right balance between need and opportunity. In response, they sought to identify highly distressed communities that demonstrated an absorptive capacity for new capital, strong anchor institutions, and connectivity to infrastructure and markets.

EIG recently surveyed state officials involved in designating Opportunity Zones. We have combined responses from 40 states with additional insights gleaned from conversations and online resources to build a thorough understanding of how states selected their zones.

States consulted heavily with their municipalities, counties, and local and regional economic development organizations to assemble their portfolios of Opportunity Zones.

“The Promise of Opportunity Zones”

May 17, 2025

Introduction

Chairman Paulsen, Ranking Member Heinrich, and members of the committee: it is a pleasure to be with you today.

I am the Co-founder and President of the Economic Innovation Group (EIG), a bipartisan research and advocacy organization. EIG helped to design and champion the Investing in Opportunity Act, legislation authored by Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI). This legislation, which enjoyed broad bipartisan support, was the basis for the Opportunity Zones provision in the Tax Cuts and Jobs Act (TCJA) of 2017.

The Opportunity Zones initiative is the most ambitious federal attempt to boost private investment in low-income areas in a generation, one with the potential to drive billions of dollars in new private investment to struggling communities over the coming decade. Since Opportunity Zones became law, EIG has worked closely with state and local policymakers, community organizations, philanthropies, and leading investors to raise awareness, provide analysis, and gather feedback in support of timely and effective implementation nationwide.

In the testimony that follows, I will:

Highlight key design features of the Opportunity Zones incentive;

Provide an overview and analysis of the state selection process and outcomes;

Underscore what states, cities, and the federal government should do to make Opportunity Zones successful; and,

Address ways to define and measure success.

Key features of the Opportunity Zones incentive

The fundamental purpose of Opportunity Zones is to encourage long-term equity investments in struggling communities. In pursuing this goal, Congress established an incentive framework flexible enough to support a broad array of investments and encourage creative local implementation strategies. The unique structure – and equity focus – of this incentive has the potential to unlock an entirely new category of investors and create an important new asset class of investments. Congress designed Opportunity Zones to complement existing community development programs while incorporating lessons learned from previous place-based efforts. I want to draw particular attention to two of its most important distinguishing features:

First, it is a highly flexible incentive that can be used to fund an array of equity investments in a variety of different sectors. This is critical, because low-income communities have a wide range of needs, and Opportunity Zones at their best will recruit investments in a variety of mutually enforcing enterprises that together improve the equilibrium of the local community. The structural flexibility extends to Opportunity Funds, the intermediaries that raise and deploy capital into Opportunity Zones. These funds can be nimble in responding to market interest and opportunity, thereby widening the aperture of investors who can participate. And, because Opportunity Funds do not need pre-approval for transactions, the cost, complexity, and time needed to deploy capital should be lower than in other programs.

Second, the incentive is nationally scalable. There is no fixed cap on the amount on capital that can be channeled to target communities via Opportunity Funds, nor is there a limit on the number of Opportunity Zones that can receive investments in any given year. This scalability derives from that fact that investors are incented to reinvest their own capital gains without any up-front subsidy or allocation. EIG’s analysis of Federal Reserve data found an estimated $6.1 trillion dollars in unrealized capital gains held by U.S. households and corporations as of the end of 2017. Even a small fraction of these gains reinvested into Opportunity Zones would make it the largest economic development initiative in the country.

Flexibility and scalability are essential ingredients because they unlock the vast creativity and problem-solving potential of communities and the marketplace in ways that would not be possible under a more prescriptive policy framework. Congress and the Administration should do everything possible to preserve and enhance these features as implementation moves forward in the months ahead, including through technical statutory refinements that will help ensure strong uptake among a broad spectrum of investors.

How were Opportunity Zones selected?

Congress gave governors of every state and territory the critical lead role of selecting Opportunity Zones. Under the statute, each governor was allowed nominate up to 25 percent of his or her state’s low-income community census tracts to be designated as areas where the federal tax incentive will apply.

Low-income community census tracts are generally defined as places with poverty rates of at least 20 percent or median family incomes no greater than 80 percent of the surrounding area. Nearly 32,000 tracts meet this definition nationwide, totaling roughly 43 percent of all U.S. census tracts. Thus, governors had to narrow the pool of eligible tracts down to roughly 8,700 selections. In order to offer real-world flexibility in assembling meaningful zones, governors were permitted to substitute up to 5 percent of their nominated tracts with those that met a slightly lower need threshold, as long as the tracts were contiguous with other nominated low-income community tracts. Governors were required to submit their nominations to the U.S. Department of the Treasury by April 20, and we now await the final tranche of certifications by the Secretary to complete the national map.

Congress sought to establish a national standard for Opportunity Zones while allowing local priorities to dictate the target communities. The resulting selection process was in keeping with the federalist spirit of the new law, as states went about identifying priorities, engaging stakeholders, and incorporating additional selection criteria in ways that reflected their unique local characteristics. The core challenge for governors was striking the right balance between need and opportunity. In response, they sought to identify highly distressed communities that demonstrated an absorptive capacity for new capital, strong anchor institutions, and connectivity to infrastructure and markets.

EIG recently surveyed state officials involved in designating Opportunity Zones. We have combined responses from 40 states with additional insights gleaned from conversations and online resources to build a thorough understanding of how states selected their zones.

States consulted heavily with their municipalities, counties, and local and regional economic development organizations to assemble their portfolios of Opportunity Zones.

PROPERTY FACTS

Sale Type

Investment

Sale Conditions

Property Type

Retail

Building Size

40,000 SF

Building Class

C

Year Built

1920

Price

$2,354,000

Price Per SF

$58.85

Percent Leased

100%

Tenancy

Multiple

Building Height

3 Stories

Building FAR

1.29

Lot Size

0.71 AC

Opportunity Zone

Yes

Zoning

C-2 - Commercial, C-2

AMENITIES

- Air Conditioning

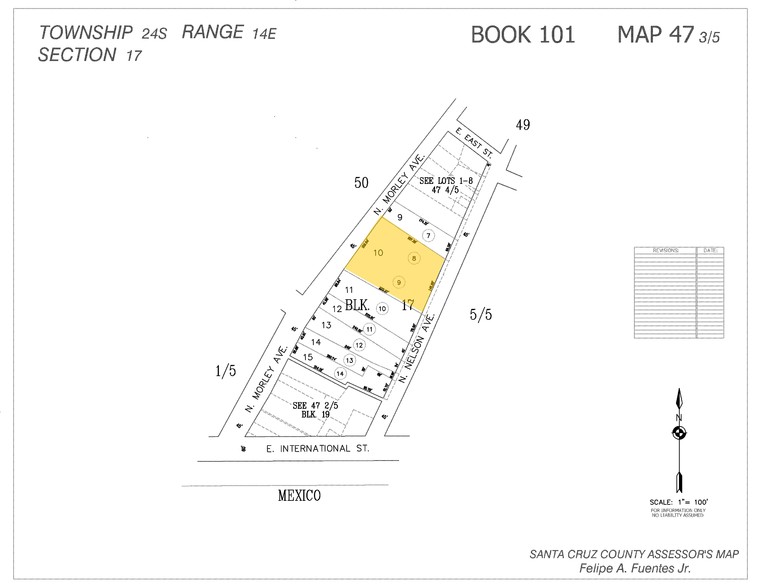

ABOUT 104-120 N MORLEY AVE , NOGALES, AZ 85621

MORLEY avenue 30, 000 retail and 10 thousand sq ft of apartments! Former Hotel Can also work as Low Income housing. With some renovations.

NEARBY MAJOR RETAILERS

PROPERTY TAXES

| Parcel Numbers | Improvements Assessment | $71,633 | |

| Land Assessment | $6,646 | Total Assessment | $78,279 |

PROPERTY TAXES

Parcel Numbers

Land Assessment

$6,646

Improvements Assessment

$71,633

Total Assessment

$78,279

1 of 3

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Presented by

104-120 N Morley Ave

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.