B of A/ Strong Deposits/Hard Corner/1.96 Acre | 1211 W Foothill Blvd

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

B of A/ Strong Deposits/Hard Corner/1.96 Acre 1211 W Foothill Blvd

9,348 SF Retail Building Upland, CA 91786 $6,774,000 ($725/SF) 4.50% Cap Rate

Investment Highlights

- Strong Bank Deposits | Over $322M Confirmed Branch Deposits (October 2024) | 2nd Largest Banking Institution in the U.S.

- Growing Rental Increases Every 5 Years during Option Periods at Fair Market Value

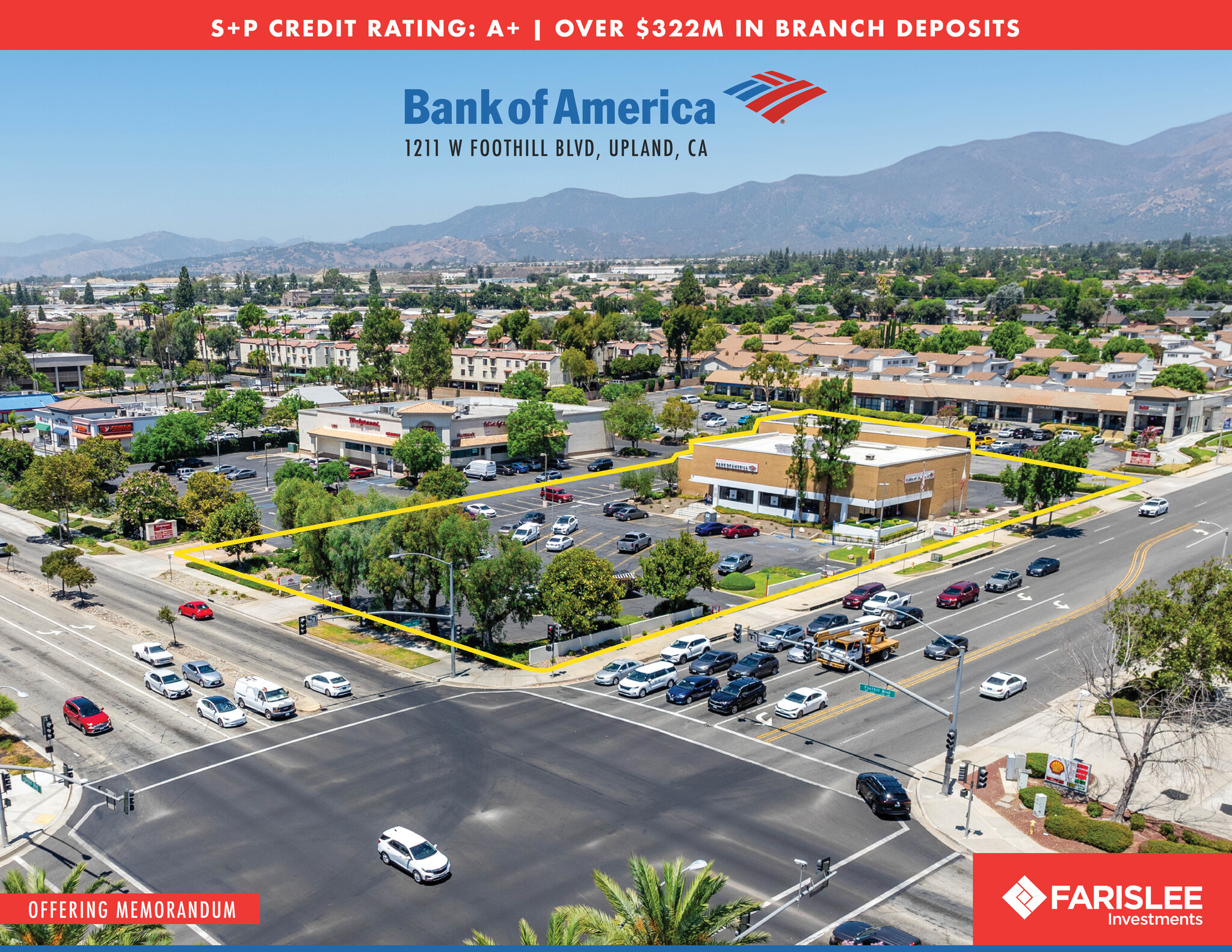

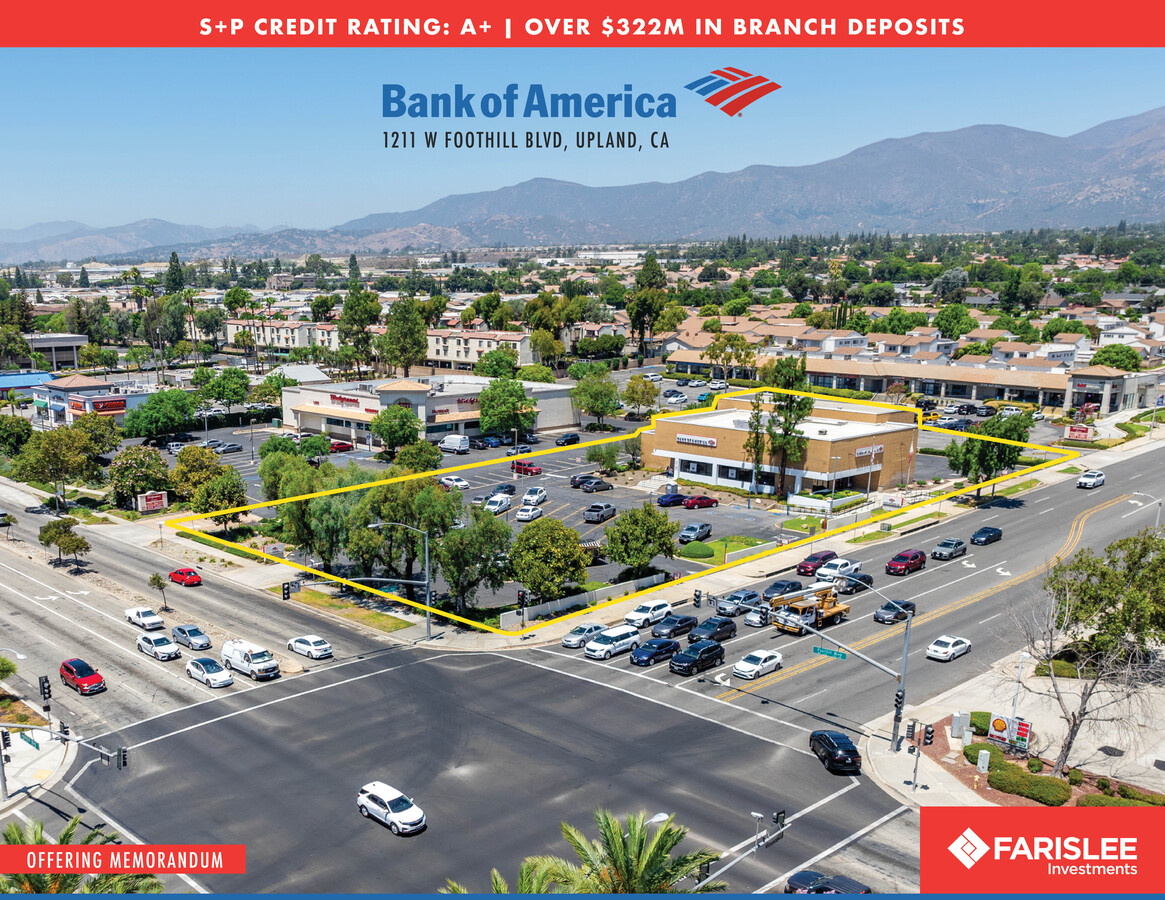

- Large Land Parcel at 1.96 Acres - Signalized Hard Corner Location

- Investment Grade, National/Credit Tenant – Bank of America (NYSE: BAC) | S+P Credit Rating: A+

- Long-Term Absolute NNN Ground Lease - Tenant Operating Since 1970

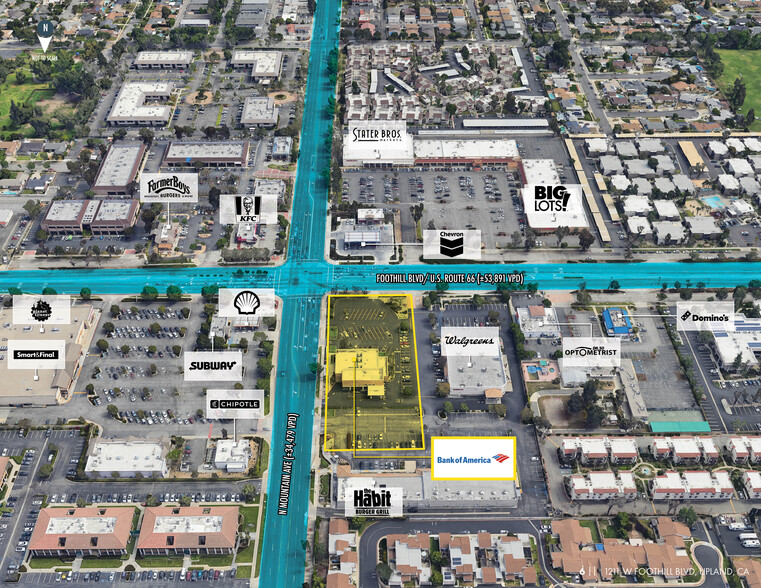

- Excellent Trade Area Demographics, 156,000 People w/in 3-Miles | Near I-10, I-15, and I-210 | AHHI Over $113,400 within a 3 Mile Radius

Executive Summary

Faris Lee Investments proudly presents a high-performing investment opportunity secured by a single-tenant NNN ground lease with Bank of America, located at the prominent intersection of Foothill Boulevard and North Mountain Avenue in Upland, CA. This Bank of America branch has demonstrated exceptional performance, with confirmed branch deposits exceeding $322 million as of October 2024, reflecting the location’s vitality and long-term viability. Situated at a high-traffic, hard-corner location with over 88,000 vehicles per day, this asset benefits from excellent visibility and accessibility in a thriving area known as the gateway to the Inland Empire.

Bank of America, a Fortune 500 company and an investment-grade credit tenant with an A+ S&P rating, offers stability and appeal for investors. As the second-largest financial institution in the U.S. by market capitalization, Bank of America serves over 69 million customers worldwide, operating 3,900 retail centers and more than 15,000 ATMs. This long-standing tenant has been operating at this branch since 1970, underscoring its commitment to the location and ensuring dependable returns for investors. The absolute NNN ground lease structure further simplifies the investment, as Bank of America covers all property expenses, including roof and structure, parking lot, CAM, property taxes, and insurance, making this a low-maintenance/management asset, with zero landlord responsibilities.

The lease includes substantial potential for rental growth, with built-in rental increases tied to Fair Market Value (FMV) adjustments. Historically, the rent has increased significantly, with a 39.87% growth from 2014 - 2019 and a further 37.53% increase from 2019 to 2024 as Bank of America exercised its first option. With one remaining option period, investors stand to benefit from continued rent growth tied to FMV, ensuring future income increases that serve as a hedge against inflation and support long-term appreciation.

Set on a large 1.96-acre parcel, this property offers both immediate returns and long-term development potential. Upland’s strategic location on the western edge of San Bernardino County, adjacent to Los Angeles County, combines historic charm with accessibility via major freeways (I-10, I-15, and I-210), enhancing the area’s commercial appeal. The property serves a high-density population of over 156,000 within a 3-mile radius, with average household incomes above $113,400, highlighting the area’s economic strength and demand for financial services.

With over a century of history and industry leadership, Bank of America remains a cornerstone of American banking, renowned for its innovation and service reach. This high-performing, long-term ground-leased asset in a high densely populated, affluent area offers investors stable returns, income growth potential, large land parcel for potential future upside, and the security of a globally recognized tenant in a highly desirable Inland Empire location.

Bank of America, a Fortune 500 company and an investment-grade credit tenant with an A+ S&P rating, offers stability and appeal for investors. As the second-largest financial institution in the U.S. by market capitalization, Bank of America serves over 69 million customers worldwide, operating 3,900 retail centers and more than 15,000 ATMs. This long-standing tenant has been operating at this branch since 1970, underscoring its commitment to the location and ensuring dependable returns for investors. The absolute NNN ground lease structure further simplifies the investment, as Bank of America covers all property expenses, including roof and structure, parking lot, CAM, property taxes, and insurance, making this a low-maintenance/management asset, with zero landlord responsibilities.

The lease includes substantial potential for rental growth, with built-in rental increases tied to Fair Market Value (FMV) adjustments. Historically, the rent has increased significantly, with a 39.87% growth from 2014 - 2019 and a further 37.53% increase from 2019 to 2024 as Bank of America exercised its first option. With one remaining option period, investors stand to benefit from continued rent growth tied to FMV, ensuring future income increases that serve as a hedge against inflation and support long-term appreciation.

Set on a large 1.96-acre parcel, this property offers both immediate returns and long-term development potential. Upland’s strategic location on the western edge of San Bernardino County, adjacent to Los Angeles County, combines historic charm with accessibility via major freeways (I-10, I-15, and I-210), enhancing the area’s commercial appeal. The property serves a high-density population of over 156,000 within a 3-mile radius, with average household incomes above $113,400, highlighting the area’s economic strength and demand for financial services.

With over a century of history and industry leadership, Bank of America remains a cornerstone of American banking, renowned for its innovation and service reach. This high-performing, long-term ground-leased asset in a high densely populated, affluent area offers investors stable returns, income growth potential, large land parcel for potential future upside, and the security of a globally recognized tenant in a highly desirable Inland Empire location.

Property Facts

Sale Type

Investment NNN

Property Type

Retail

Property Subtype

Building Size

9,348 SF

Building Class

B

Year Built

1970

Price

$6,774,000

Price Per SF

$725

Cap Rate

4.50%

NOI

$304,850

Tenancy

Single

Building Height

1 Story

Building FAR

0.11

Lot Size

1.96 AC

Zoning

Commercial

Parking

60 Spaces (7.43 Spaces per 1,000 SF Leased)

Frontage

186 FT on W Foothill Blvd

Amenities

- Bus Line

- Signalized Intersection

- Drive Thru

Walk Score ®

Very Walkable (88)

Nearby Major Retailers

PROPERTY TAXES

| Parcel Number | 1006-511-44 | Improvements Assessment | $940,237 |

| Land Assessment | $596,324 | Total Assessment | $1,536,561 |

PROPERTY TAXES

Parcel Number

1006-511-44

Land Assessment

$596,324

Improvements Assessment

$940,237

Total Assessment

$1,536,561

1 of 6

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Presented by

B of A/ Strong Deposits/Hard Corner/1.96 Acre | 1211 W Foothill Blvd

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.