Log In/Sign Up

Your email has been sent.

17 Commercial Assets 15 Properties in Multiple Locations

INVESTMENT HIGHLIGHTS

- Comprises 14 standalone retail/restaurant properties and 2 pieces of land offered by PropertyGroupUSA as part of a portfolio repositioning.

- Primary groupings include former CVS locations, auto shops (mostly Pep Boys), two food service, and big-box buildings.

- Explore creative uses: Hard corner positions, drive-thrus, second-generation equipment, and more.

- Value-add or adaptive reuse opportunities: All buildings are vacant with flexible zoning, some in opportunity zones.

- Average retail vacancy rate across cities is 4.6% as of Q3 2024; rental rates rose 5.8% from 2023 to 2024, according to CoStar.

- Properties are available individually and in groupings. Ownership will consider attractive offers for the entire portfolio. Inquire now.

EXECUTIVE SUMMARY

This 17-property portfolio offers investors the opportunity to expand their holdings by purchasing individual locations, select groupings of similar properties, or the entire portfolio. This nationwide property offering is facilitated by NEWAMCO.ORG. The seller group aims to divest certain assets to realign its portfolio towards targeted sectors.

The properties in this portfolio range from a 2,575-square-foot former Taco Bell to a former 55,000-square-foot big-box Academy Sports and development land, showcasing a diverse array of assets. The built property types include former CVS Pharmacy and Pep Boys automotive repair buildings, complemented by two big-box stores and two restaurants. Each property is freestanding, standalone, and vacant and benefits from flexible zoning and not being part of other shopping centers, thus offering maximum versatility. Certain properties feature unique attributes such as drive-thrus, restaurant equipment, and drive-in doors, which enhance their adaptability for various future uses. In addition, the micro-locational benefits make them attractive to a wide range of buyers, with the corresponding cities and markets performing exceptionally well. The larger acreage commercial tracts boast excellent frontage along strong retail corridors with new developments coming around them. Two strongly positioned land parcels present dynamic development opportunities.

The wide blend of property offerings presents ample 1031 READY exchange options in price, geography and industry sector opportunities.

The markets surrounding each property show solid signs for successful investments, supported by multifaceted economies that promote diverse uses. More than half of the properties are located on hard corners, and some are in designated opportunity zones.

For more information, please refer to the attached documents and contact Randall Perry at 727-755-3249.

The properties in this portfolio range from a 2,575-square-foot former Taco Bell to a former 55,000-square-foot big-box Academy Sports and development land, showcasing a diverse array of assets. The built property types include former CVS Pharmacy and Pep Boys automotive repair buildings, complemented by two big-box stores and two restaurants. Each property is freestanding, standalone, and vacant and benefits from flexible zoning and not being part of other shopping centers, thus offering maximum versatility. Certain properties feature unique attributes such as drive-thrus, restaurant equipment, and drive-in doors, which enhance their adaptability for various future uses. In addition, the micro-locational benefits make them attractive to a wide range of buyers, with the corresponding cities and markets performing exceptionally well. The larger acreage commercial tracts boast excellent frontage along strong retail corridors with new developments coming around them. Two strongly positioned land parcels present dynamic development opportunities.

The wide blend of property offerings presents ample 1031 READY exchange options in price, geography and industry sector opportunities.

The markets surrounding each property show solid signs for successful investments, supported by multifaceted economies that promote diverse uses. More than half of the properties are located on hard corners, and some are in designated opportunity zones.

For more information, please refer to the attached documents and contact Randall Perry at 727-755-3249.

SALE FLYER

PROPERTY FACTS

| Sale Type | Investment | Individually For Sale | 15 |

| Status | Active | Total Building Size | 260,941 SF |

| Number of Properties | 15 | Total Land Area | 38.23 AC |

| Sale Type | Investment |

| Status | Active |

| Number of Properties | 15 |

| Individually For Sale | 15 |

| Total Building Size | 260,941 SF |

| Total Land Area | 38.23 AC |

PROPERTIES

Show More > < Show Less

1 1

SALE ADVISOR

SALE ADVISOR

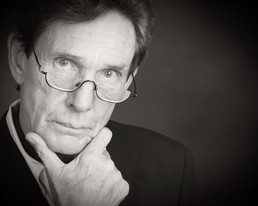

Randall Perry, Private Family Office Administrator

Private Family Office Administrator

1 of 20

VIDEOS

MATTERPORT 3D EXTERIOR

MATTERPORT 3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

1 of 1

Presented by

NEWAMCO

17 Commercial Assets

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.