201 E 9th St

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

201 E 9th St

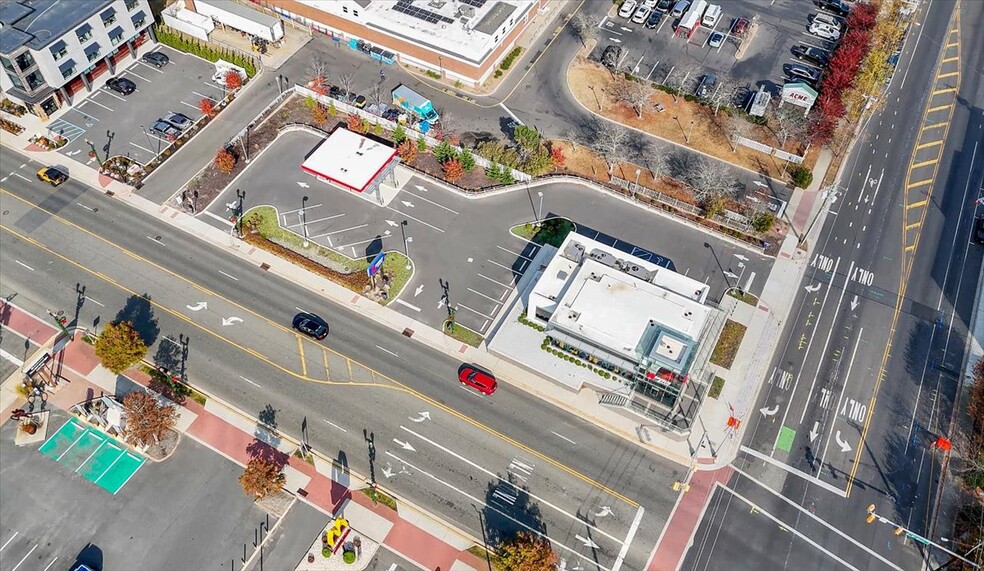

2,789 SF Retail Building Ocean City, NJ 08226 $2,400,000 ($860.52/SF)

EXECUTIVE SUMMARY

FINAL CALL FOR OFFERS!!! All offers due 1/10/2025 by 5:00 PM Eastern.This impressive bank building, located in the heart of Ocean City, New Jersey, offers an unparalleled investment or development opportunity in one of the area’s most desirable locations. With high-end finishes and a sleek, full-glass facade, the property stands out as a modern and attractive asset, ideal for continued banking use or other commercial redevelopment.

The building’s design and positioning make it an ideal fit for investors or developers looking to tap into Ocean City’s thriving market. The layout and location make is suitable for redevelopment into retail, office, or other high-end commercial applications, as well as continued use as a bank or financial center. The striking full-glass frontage not only elevates curb appeal but also maximizes natural light throughout the building. There is luxurious imported marble flooring throughout the building adding a touch of elegance and sophistication, creating a refined atmosphere that will impress clients and elevate the building’s aesthetic appeal. With premium interior and exterior finishes, it offers a polished, professional aesthetic that appeals to upscale clientele. Equipped with a large, high-security vault containing safe deposit boxes in various sizes, making this property especially attractive for financial institutions or businesses needing secure options.

There is ample parking providing convenience for customers or future tenants with dedicated parking spaces in a busy area where parking is often at a premium. The location is situated in a high-traffic area, providing excellent visibility and easy access, ensuring a consistent flow of potential clients.

Property sold “as is”. Buyer and/or Buyer’s agent responsible for verifying all pertinent information deemed relevant by the prospective buyer, including but not limited to square footage, acreage, utilities, taxes, zoning, permitting, condition. etc.

"CALL FOR OFFERS:

Buyers should submit offers utilizing a letter of intent and due by 12/9/2024. Buyers may request an outline for the letter of intent from the listing agent. Once an offer/offers are submitted, the following procedure will be implemented for offer review:

1. All offers will be presented to Asset Managers for review.

2. Asset Manager will review and submit all offers to FDIC for consideration with a recommendation to proceed with one to contract.

3. The Local Broker will provide a Letter of Intent package to the prospective Buyer to review. Please see the attached contract, terms, and attachments. It is the Buyer's responsibility to review and approve the attached contract prior to the submission of an offer to purchase.

4. Buyer returns signed LOI while simultaneously submitting the required earnest money deposit

5. Asset Manager will write a case to support the proposed offer while providing information on all offers. Please note it is not a binding agreement until FDIC executes the contract.

6. Case is submitted to FDIC for review.

7. FDIC chooses to execute or reject the proposed offer.

8. If approved, FDIC will send the contract to the buyer through their electronic portal for signatures.

9. Contract timelines begin once executed by FDIC.

10. Once any due diligence or financing contingencies are cleared, the earnest money becomes hard, and the contract moves toward close.

11. Contract closes per the timeline outlined in the agreement, and funds are disbursed to all parties.

PLEASE NOTE ALL OFFERS AND SOURCE OF FUNDS WILL BE REVIEWED AT TIME OF OFFER SUBMISSION BY ASSET MANAGERS FOR FDIC. FDIC reserves the right to change the above process, reject all offers, call for a best and final, or cancel the sale."

The building’s design and positioning make it an ideal fit for investors or developers looking to tap into Ocean City’s thriving market. The layout and location make is suitable for redevelopment into retail, office, or other high-end commercial applications, as well as continued use as a bank or financial center. The striking full-glass frontage not only elevates curb appeal but also maximizes natural light throughout the building. There is luxurious imported marble flooring throughout the building adding a touch of elegance and sophistication, creating a refined atmosphere that will impress clients and elevate the building’s aesthetic appeal. With premium interior and exterior finishes, it offers a polished, professional aesthetic that appeals to upscale clientele. Equipped with a large, high-security vault containing safe deposit boxes in various sizes, making this property especially attractive for financial institutions or businesses needing secure options.

There is ample parking providing convenience for customers or future tenants with dedicated parking spaces in a busy area where parking is often at a premium. The location is situated in a high-traffic area, providing excellent visibility and easy access, ensuring a consistent flow of potential clients.

Property sold “as is”. Buyer and/or Buyer’s agent responsible for verifying all pertinent information deemed relevant by the prospective buyer, including but not limited to square footage, acreage, utilities, taxes, zoning, permitting, condition. etc.

"CALL FOR OFFERS:

Buyers should submit offers utilizing a letter of intent and due by 12/9/2024. Buyers may request an outline for the letter of intent from the listing agent. Once an offer/offers are submitted, the following procedure will be implemented for offer review:

1. All offers will be presented to Asset Managers for review.

2. Asset Manager will review and submit all offers to FDIC for consideration with a recommendation to proceed with one to contract.

3. The Local Broker will provide a Letter of Intent package to the prospective Buyer to review. Please see the attached contract, terms, and attachments. It is the Buyer's responsibility to review and approve the attached contract prior to the submission of an offer to purchase.

4. Buyer returns signed LOI while simultaneously submitting the required earnest money deposit

5. Asset Manager will write a case to support the proposed offer while providing information on all offers. Please note it is not a binding agreement until FDIC executes the contract.

6. Case is submitted to FDIC for review.

7. FDIC chooses to execute or reject the proposed offer.

8. If approved, FDIC will send the contract to the buyer through their electronic portal for signatures.

9. Contract timelines begin once executed by FDIC.

10. Once any due diligence or financing contingencies are cleared, the earnest money becomes hard, and the contract moves toward close.

11. Contract closes per the timeline outlined in the agreement, and funds are disbursed to all parties.

PLEASE NOTE ALL OFFERS AND SOURCE OF FUNDS WILL BE REVIEWED AT TIME OF OFFER SUBMISSION BY ASSET MANAGERS FOR FDIC. FDIC reserves the right to change the above process, reject all offers, call for a best and final, or cancel the sale."

PROPERTY FACTS Under Contract

Sale Type

Investment

Property Type

Retail

Property Subtype

Bank

Building Size

2,789 SF

Building Class

B

Year Built

2022

Price

$2,400,000

Price Per SF

$860.52

Tenancy

Single

Building Height

1 Story

Building FAR

0.10

Lot Size

0.63 AC

Parking

3 Spaces (1.08 Spaces per 1,000 SF Leased)

Frontage

72’ on East 9th Street

Walk Score®

Very Walkable (88)

Bike Score®

Biker's Paradise (99)

NEARBY MAJOR RETAILERS

PROPERTY TAXES

| Parcel Number | 08-00808-0000-00001 | Improvements Assessment | $1,952,700 |

| Land Assessment | $1,962,900 | Total Assessment | $3,915,600 |

PROPERTY TAXES

Parcel Number

08-00808-0000-00001

Land Assessment

$1,962,900

Improvements Assessment

$1,952,700

Total Assessment

$3,915,600

1 of 18

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Presented by

201 E 9th St

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.