6.52% CAP Warehouse with Corporate Guaranty | 2512 Hemphill St

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

6.52% CAP Warehouse with Corporate Guaranty 2512 Hemphill St

8,100 SF Retail Building Fort Worth, TX 76110 $1,700,000 ($210/SF) 6.52% Cap Rate

Investment Highlights

- 6.52% CAP, NNN Lease

- New Interior MEPs Constructed 2022 and 10-ton HVAC unit

- Rare Centrally Located Last Mile Distribution Warehouse

- Strong National Tenant with Corporate Guaranty

- 300A, 120/208V, 3 phase power on new electrical panel

- Minutes From Major Interstates I-35W, I-20, I-30

Executive Summary

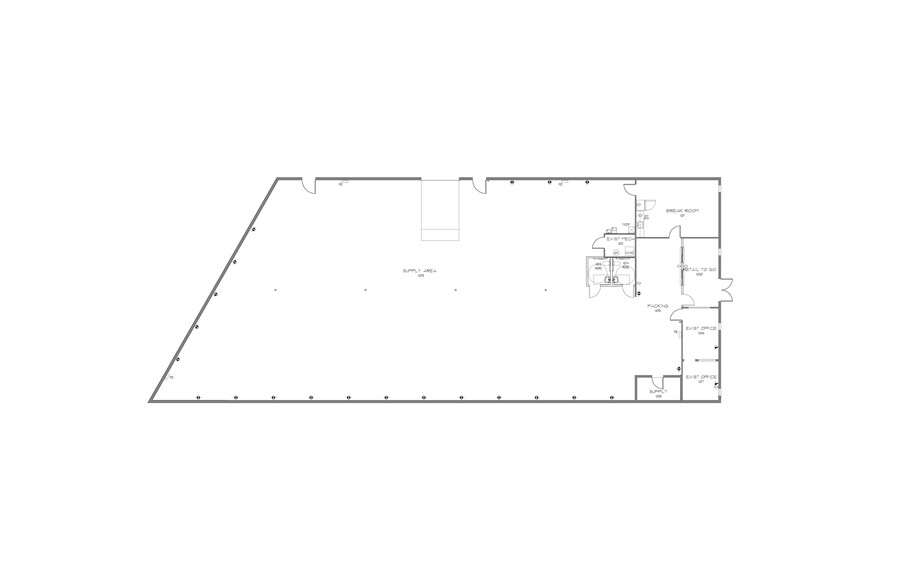

This street-front, high-traffic property at 2512 Hemphill St. in Fort Worth, TX has new lighting, electrical, plumbing, paint, polished concrete floors, and landscaping. It’s a prime investment opportunity for anyone seeking a cash flowing piece of real estate in one of the hottest markets in the US. This 8,100 SF building is accessed by two grade level 7’ doors on the north side of building facing the parking lot, an 8x8 roll up grade door, and a double door at the main entrance. This warehouse-like building hosts two offices, a breakroom, two ADA compliant bathrooms, a reception area, and a 6,377 SF supply area. 22 dedicated quadraplex outlets in the supply area and new LED strip lighting throughout the building are fed by 300A, 120/208V, 3 phase power on panels installed in late 2021. Two RTUs service this building. One new 10-ton Carrier gas WeatherMaker 50TC unit was installed in 2022, and a new gas hot water heater was installed for operation in spring 2022 when the latest Certificate of Occupancy was obtained by the current tenant. The single ply TPO roofing system is mechanically fastened over two layers of ISO and is in good condition. The parking lot allows for 12 vehicles with 2 additional street spaces in the front of the building.

With an established tenant until February of 2027, the property is an ideal investment sale. The current Tenant, DashMart, a subsidiary of DoorDash, Inc., is of great creditworthiness and offers an investor peace of mind.

DashMart is an online convenience store that offers a wide range of household essentials for delivery on-demand. It operates as a dark store designed exclusively for online order fulfillment. DashMart products include fresh and frozen foods, pantry staples, personal care items, pet supplies, and more. DashMart benefits from DoorDash’s expertise in logistics and delivery, as well as its extensive network of drivers and couriers. DashMart launched mid 2020 as a strategic expansion for DoorDash to diversify its revenue streams and offer customers a wider range of services beyond food delivery.

Asking $1.7M at an above market CAP rate of 6.52% in a triple net lease with annual rental escalations and two 36-month renewals, this cash flowing property delivers a good balance of financial stability and ample opportunity to obtain a higher yield. 2024 NOI is $111K. 2025 at 6.7% CAP with NOI at $114K.

With an established tenant until February of 2027, the property is an ideal investment sale. The current Tenant, DashMart, a subsidiary of DoorDash, Inc., is of great creditworthiness and offers an investor peace of mind.

DashMart is an online convenience store that offers a wide range of household essentials for delivery on-demand. It operates as a dark store designed exclusively for online order fulfillment. DashMart products include fresh and frozen foods, pantry staples, personal care items, pet supplies, and more. DashMart benefits from DoorDash’s expertise in logistics and delivery, as well as its extensive network of drivers and couriers. DashMart launched mid 2020 as a strategic expansion for DoorDash to diversify its revenue streams and offer customers a wider range of services beyond food delivery.

Asking $1.7M at an above market CAP rate of 6.52% in a triple net lease with annual rental escalations and two 36-month renewals, this cash flowing property delivers a good balance of financial stability and ample opportunity to obtain a higher yield. 2024 NOI is $111K. 2025 at 6.7% CAP with NOI at $114K.

Property Facts

Sale Type

Investment NNN

Property Type

Building Size

8,100 SF

Building Class

C

Year Built

1960

Price

$1,700,000

Price Per SF

$210

Cap Rate

6.52%

NOI

$110,840

Tenancy

Single

Building Height

1 Story

Building FAR

0.02

Lot Size

10.00 AC

Zoning

E - E- Neighborhood Commercial. Retail sales, banks, offices, bakeries, healthcare, and alcohol sales for off premise consumption. Maximum 45 ft. height.

Parking

12 Spaces (1.48 Spaces per 1,000 SF Leased)

Bike Score ®

Very Bikeable (72)

Nearby Major Retailers

PROPERTY TAXES

| Parcel Number | 01313622 | Improvements Assessment | $762,169 |

| Land Assessment | $58,280 | Total Assessment | $820,449 |

PROPERTY TAXES

Parcel Number

01313622

Land Assessment

$58,280

Improvements Assessment

$762,169

Total Assessment

$820,449

1 of 17

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Presented by

6.52% CAP Warehouse with Corporate Guaranty | 2512 Hemphill St

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.