NNN Retail/Medical/Dental Center | 215K NOI | 841 Enfield St

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

NNN Retail/Medical/Dental Center | 215K NOI 841 Enfield St

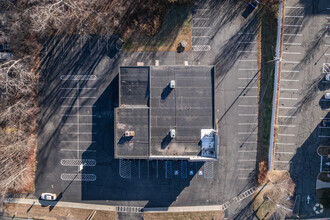

7,790 SF 46% Leased Retail Building Online Auction Sale Enfield, CT 06082

Investment Highlights

- Three-tenant medical/retail strip center with owner-user medical opportunity.

- Property comes equipped with in-place NNN leases and fee simple ownership with minimal landlord responsibilities.

- Positioned directly off Interstate 91 near a signalized, hard-corner intersection fronting a primary thoroughfare with prominent signage.

- Situated in a dense retail corridor close to Enfield Square Mall, a 788,000-square-foot regional mall anchored by Target, across from Town Hall.

Executive Summary

841 Enfield Street presents investors and owner users with the perfect NNN opportunity in Enfield, located directly across from the Town Hall and next to National Retailers. The three-tenant retail strip center rings in at an impressive 7,790 square feet spread across 1.33 acres. Built in 2015, the single-story property has been meticulously maintained. There are little capital expenditures needed for this asset due to its recent construction. In 2020, the parking lot was repaired, and the medical spa tenant invested $300,000 into their space, demonstrating a long-term commitment to the site. This investment is attractive to investors due to the NNN leases in place minimizing landlord responsibilities. Tenants are reimbursed for CAM, insurance, taxes, and management. Landlord responsibilities are limited to maintaining and repairing the exterior of the premises. This creates the ideal, low-management investment for a passive investor and provides an opportunity for an owner user of 4,250SF fully built out medical/dental center for Columbia Dental.

The Enfield Retail Submarket is the perfect place for investors to enter. Vacancy in the submarket is low at 4.2% compared to the five-year average of 6.3%. The Enfield retail submarket has roughly 670,000 square feet of space listed as available. As of the fourth quarter of 2024, there is no retail space under construction in Enfield. In comparison, the submarket has averaged 11,000 square feet of under-construction inventory over the past 10 years. Rents in the retail sector have edged up by 1.2% year-over-year in Enfield compared to a change of 0.8% across Hartford as a whole.

Enfield benefits from being a part of the larger Hartford, Connecticut, retail landscape. According to the latest preliminary data released by the Bureau of Labor Statistics (BLS), metropolitan Hartford's labor market continued to expand in June, bringing seasonally adjusted payrolls to 589,200. On a year-over-year basis, this represents a 7,800-job expansion in Hartford's workforce. 841 Enfield Street is a perfectly poised retail asset in Enfield. Situated near the signalized hard corner intersection of Enfield Street and N Main Street/Elm Street the property is highly visible. The asset is located less than a mile from the on/off ramp access to Interstate 91. Fronting Enfield Street, one of the primary thoroughfares seeing over 14,600 vehicles per day. There is plenty of nearby retail, ranging from local establishments to national chains, including Chick-fil-A, Subway, Costco, Target, The Home Depot, ShopRite, and others.

841 Enfield Street is the perfect NNN, hand-off investment in the booming town of Enfield.

Property tours are available by appointment only. Please contact the listing broker to schedule.

The Enfield Retail Submarket is the perfect place for investors to enter. Vacancy in the submarket is low at 4.2% compared to the five-year average of 6.3%. The Enfield retail submarket has roughly 670,000 square feet of space listed as available. As of the fourth quarter of 2024, there is no retail space under construction in Enfield. In comparison, the submarket has averaged 11,000 square feet of under-construction inventory over the past 10 years. Rents in the retail sector have edged up by 1.2% year-over-year in Enfield compared to a change of 0.8% across Hartford as a whole.

Enfield benefits from being a part of the larger Hartford, Connecticut, retail landscape. According to the latest preliminary data released by the Bureau of Labor Statistics (BLS), metropolitan Hartford's labor market continued to expand in June, bringing seasonally adjusted payrolls to 589,200. On a year-over-year basis, this represents a 7,800-job expansion in Hartford's workforce. 841 Enfield Street is a perfectly poised retail asset in Enfield. Situated near the signalized hard corner intersection of Enfield Street and N Main Street/Elm Street the property is highly visible. The asset is located less than a mile from the on/off ramp access to Interstate 91. Fronting Enfield Street, one of the primary thoroughfares seeing over 14,600 vehicles per day. There is plenty of nearby retail, ranging from local establishments to national chains, including Chick-fil-A, Subway, Costco, Target, The Home Depot, ShopRite, and others.

841 Enfield Street is the perfect NNN, hand-off investment in the booming town of Enfield.

Property tours are available by appointment only. Please contact the listing broker to schedule.

Data Room Click Here to Access

- Operating and Financials

- Purchase Agreement

- Third Party Reports

- Title and Insurance

Market Analytics Click Here to Access

{{summary.v}}

{{summary.t}}

{{headerValue}}

{{rowValue.t}}

{{rowValue.to}}

{{rowValue.l}}

{{rowValue.h}}

{{summary.v}}

{{summary.t}}

{{headerValue}}

{{rowValue.t}}

{{rowValue.a}}

{{rowValue.l}}

{{rowValue.h}}

{{rowValue.m}}

Market Sale Price per SF

Hartford - CT USA

Market Cap Rate

Hartford - CT USA

Market Sale Price per SF by Star Rating

1 - 2 Star

3 Star

4 - 5 Star

Market Cap Rate by Star Rating

1 - 2 Star

3 Star

4 - 5 Star

Market Sale Price per SF Distribution

Market Cap Rate Distribution

Financial Summary (Actual - 2023) Click Here to Access |

Annual | Annual Per SF |

|---|---|---|

| Gross Rental Income |

-

|

-

|

| Other Income |

-

|

-

|

| Vacancy Loss |

-

|

-

|

| Effective Gross Income |

-

|

-

|

| Net Operating Income |

$99,999

|

$9.99

|

Financial Summary (Actual - 2023) Click Here to Access

| Gross Rental Income | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Other Income | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Vacancy Loss | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Effective Gross Income | |

|---|---|

| Annual | - |

| Annual Per SF | - |

| Net Operating Income | |

|---|---|

| Annual | $99,999 |

| Annual Per SF | $9.99 |

Property Facts

Sale Type

Investment

Sale Condition

Auction Sale

Property Type

Retail

Property Subtype

Building Size

7,790 SF

Building Class

C

Year Built

2015

Percent Leased

46%

Tenancy

Multiple

Building Height

1 Story

Building FAR

0.13

Lot Size

1.33 AC

Zoning

Commercial - commercial

Parking

53 Spaces (6.8 Spaces per 1,000 SF Leased)

Frontage

218 FT on Enfield

Amenities

- Bus Line

- Corner Lot

- Freeway Visibility

- Pylon Sign

- Signage

- Signalized Intersection

Walk Score ®

Very Walkable (77)

DEMOGRAPHICS

Demographics

1 Mile

3 Mile

5 Mile

2024 Population

9,242

37,316

81,541

2020 Population

8,940

36,712

81,689

2029 Population

9,256

37,230

80,899

2024-2029 Projected Population Growth

0.2%

-0.2%

-0.8%

Daytime Employees

4,620

16,633

36,886

Total Businesses

614

2,028

3,832

Average Household Income

$79,908

$102,881

$118,829

Median Household Income

$64,711

$83,452

$95,712

Total Consumer Spending

$105.2M

$493.1M

$1.1B

Median Age

36.3

42.0

43.5

2024 Households

3,808

14,813

31,178

Percent College Degree or Above

14%

20%

21%

Average Home Value

$270,860

$291,586

$325,381

Nearby Major Retailers

PROPERTY TAXES

| Parcel Number | ENFI-000026-000000-000021 | Improvements Assessment | $443,400 (2024) |

| Land Assessment | $94,300 (2024) | Total Assessment | $537,700 (2024) |

PROPERTY TAXES

Parcel Number

ENFI-000026-000000-000021

Land Assessment

$94,300 (2024)

Improvements Assessment

$443,400 (2024)

Total Assessment

$537,700 (2024)

Sale Advisor

Michael Guidicelli, CCIM, SIOR, Broker & Owner

(860) 371-7103

Contact

Michael stands at the forefront of the investment real estate market as the esteemed Owner and Power Broker of Regions Commercial, LLC. His firm is renowned for its specialization in the sale of intricate investment properties and providing unparalleled tenant representation services. Michael's expertise is backed by his prestigious designation as a CCIM (Certified Commercial Investment Member), a testament to his deep-rooted knowledge and practical experience in commercial and investment real estate.

Throughout his illustrious career, Michael has played a pivotal role in shaping the landscape of the real estate industry. His dedication and leadership have been instrumental in his decade-long service on the Board of Directors for the Connecticut Chapter of CCIM, including two remarkable years as President (2016 & 2017). Under his stewardship, the chapter witnessed exponential growth, nearly doubling its membership and tripling its net operating income. His exceptional leadership skills were further recognized through his role as Regional Vice President of Region 11, overseeing pivotal chapters across the Northeastern United States.

Michael's commitment to excellence is also evident in his attainment of the SIOR designation from The SOCIETY OF INDUSTRIAL AND OFFICE REALTORS®, marking him as a leading authority in commercial real estate brokerage. His tenure as President of the CT/W. MA SIOR Chapter and his continued role as Immediate Past President highlight his significant contributions and steadfast dedication to the industry.

His outstanding achievements have not gone unnoticed, earning him a spot in the top 40 Under 40 by the Hartford Business Journal, and highlighting his remarkable impact in the field. Furthermore, Michael's academic credentials are equally impressive, with a graduate degree from Harvard Law School's Program on Negotiation, equipping him with unrivaled negotiation skills that benefit his clients immensely.

As a staunch advocate for his clients, Michael offers expert guidance through every step of the real estate transaction process. His commitment to his clients is unparalleled, offering both commission-based and consulting services tailored to meet their unique needs. The opportunity to begin with an initial consultation without obligation is a testament to his client-centered approach, ensuring a comprehensive understanding of their requirements from the outset.

Michael's distinguished career, marked by his leadership roles, prestigious designations, and unwavering dedication to his clients, sets him apart as a leading figure in the investment real estate industry.

Throughout his illustrious career, Michael has played a pivotal role in shaping the landscape of the real estate industry. His dedication and leadership have been instrumental in his decade-long service on the Board of Directors for the Connecticut Chapter of CCIM, including two remarkable years as President (2016 & 2017). Under his stewardship, the chapter witnessed exponential growth, nearly doubling its membership and tripling its net operating income. His exceptional leadership skills were further recognized through his role as Regional Vice President of Region 11, overseeing pivotal chapters across the Northeastern United States.

Michael's commitment to excellence is also evident in his attainment of the SIOR designation from The SOCIETY OF INDUSTRIAL AND OFFICE REALTORS®, marking him as a leading authority in commercial real estate brokerage. His tenure as President of the CT/W. MA SIOR Chapter and his continued role as Immediate Past President highlight his significant contributions and steadfast dedication to the industry.

His outstanding achievements have not gone unnoticed, earning him a spot in the top 40 Under 40 by the Hartford Business Journal, and highlighting his remarkable impact in the field. Furthermore, Michael's academic credentials are equally impressive, with a graduate degree from Harvard Law School's Program on Negotiation, equipping him with unrivaled negotiation skills that benefit his clients immensely.

As a staunch advocate for his clients, Michael offers expert guidance through every step of the real estate transaction process. His commitment to his clients is unparalleled, offering both commission-based and consulting services tailored to meet their unique needs. The opportunity to begin with an initial consultation without obligation is a testament to his client-centered approach, ensuring a comprehensive understanding of their requirements from the outset.

Michael's distinguished career, marked by his leadership roles, prestigious designations, and unwavering dedication to his clients, sets him apart as a leading figure in the investment real estate industry.

About the Auction Platform

Ten-X Commercial is the leading end-to-end digital transaction platform for commercial real estate. With over $26bn sold, Ten-X’s platform empowers brokers, sellers and buyers with data-driven technology and comprehensive marketing tools to expand market visibility and decrease time to close. Ten-X consistently yields trade rates at two times the industry average. Ten-X expedites the entire CRE transaction timeline by enabling brokers and sellers to tap into a digital platform that makes it easy to onboard properties, evaluate the success of complimentary omnichannel marketing campaigns and follow up on the strongest pre-qualified leads. Buyers are precision-matched with properties aligned with their investment goals, with unprecedented access to market analysis and due diligence documents to help them securely acquire properties online, with confidence.

Read More

Auction Contact

Emily Walper

Contact

Auctioneer License:

Ten-X, Inc. Samantha Corbat RE Brkr REB.0790949

1 of 22

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP

Transaction Fee Schedule

Based on Percentage of Winning Bid Amount.

Winning Bid Amount

Transaction Fee

$0m to < $1m

5.00% ($20,000 min)

$1m to < $3m

3.00%

$3m to < $5m

2.50%

$5m to < $10m

2.25%

$10m to < $15m

2.00%

$15m to < $25m

1.75%

$25m to < $35m

1.50%

$35M to < $45M

1.00%

$45M to < $55M

0.75%

$55M and Up

0.50%

Example Calculation

Winning Bid Amount

$4,000,000

Transaction Fee

$100,000 (2.5%)

Total Purchase Price

$4,100,000

Presented by

NNN Retail/Medical/Dental Center | 215K NOI | 841 Enfield St

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.

Presented by

NNN Retail/Medical/Dental Center | 215K NOI | 841 Enfield St

Already a member? Log In

Hmm, there seems to have been an error sending your message. Please try again.

Thanks! Your message was sent.