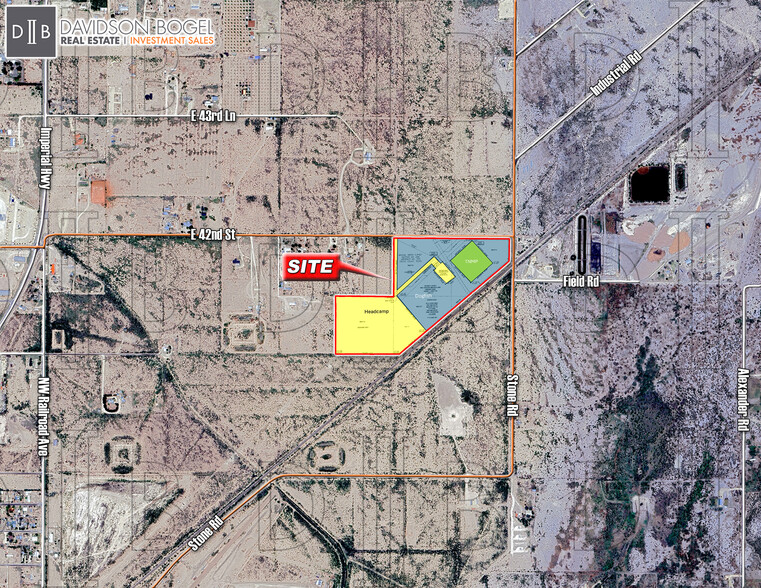

E 42nd Lane & Stone Rd | Fort Stockton, TX 79735

This feature is unavailable at the moment.

We apologize, but the feature you are trying to access is currently unavailable. We are aware of this issue and our team is working hard to resolve the matter.

Please check back in a few minutes. We apologize for the inconvenience.

- LoopNet Team

thank you

Your email has been sent!

E 42nd Lane & Stone Rd

Fort Stockton, TX 79735

Fort Stockton Energy Storage Portfolio · Land For Sale · 31.52 AC

Investment Highlights

- Rare Two (2) Tenant Energy Storage Ground Lease in Fort Stockton, TX

- Average lease term of 20 years, providing new ownership a fantastic stabilized revenue stream

- U.S. Battery Storage Capacity Expected To Nearly Double In 2024

- $273,000 in Total NOI

- 100% Leased: Gore Street Capital (LSE: GSF) & +/- 28 Locations around the World) and Excelsior Energy Capital ($1.5 Billion Assets Under Management)

- Income Tax Free State

Executive Summary

Rare Gore Street & Excelsior Energy Storage Ground Lease Portfolio

--

Gore Street Capital is a private investment management firm that focuses on energy storage solutions, helping stabilize renewable energy grids through battery energy storage systems. Founded in 2015, the firm manages the Gore Street Energy Storage Fund (GSF), the first of its kind listed on the London Stock Exchange, which gives public investors exposure to the energy storage market.

The firm’s portfolio includes over 1.2 GW of energy storage assets located across the UK, Ireland, the U.S., and Japan. Gore Street Capital plays a crucial role in supporting the global transition to sustainable energy by investing in essential energy storage infrastructure, which helps balance the variability of renewable energy sources like wind and solar. The firm’s focus on battery storage systems not only contributes to grid stability but also allows renewable energy to be more effectively integrated into national grids.

--

Excelsior Energy Capital is a private renewable energy infrastructure firm, founded around 2021. The company specializes in equity investments in middle-market wind, solar, and energy storage projects across North America. With over $1.5 billion in assets under management, they focus on long-term investments in sustainable energy, targeting value-driven opportunities for institutional investors.

Excelsior has a team with more than 70 years of combined experience in finance, law, and operations, making them a trusted partner for developers and operators. They have completed investments in multiple wind and solar projects, contributing to over 2 gigawatts of renewable energy capacity. Their primary headquarters are in Excelsior, Minnesota, with another office in Portland, Oregon. The firm’s first renewable energy investment fund closed in 2021 with $504 million, surpassing their initial goal.

--

Gore Street Capital is a private investment management firm that focuses on energy storage solutions, helping stabilize renewable energy grids through battery energy storage systems. Founded in 2015, the firm manages the Gore Street Energy Storage Fund (GSF), the first of its kind listed on the London Stock Exchange, which gives public investors exposure to the energy storage market.

The firm’s portfolio includes over 1.2 GW of energy storage assets located across the UK, Ireland, the U.S., and Japan. Gore Street Capital plays a crucial role in supporting the global transition to sustainable energy by investing in essential energy storage infrastructure, which helps balance the variability of renewable energy sources like wind and solar. The firm’s focus on battery storage systems not only contributes to grid stability but also allows renewable energy to be more effectively integrated into national grids.

--

Excelsior Energy Capital is a private renewable energy infrastructure firm, founded around 2021. The company specializes in equity investments in middle-market wind, solar, and energy storage projects across North America. With over $1.5 billion in assets under management, they focus on long-term investments in sustainable energy, targeting value-driven opportunities for institutional investors.

Excelsior has a team with more than 70 years of combined experience in finance, law, and operations, making them a trusted partner for developers and operators. They have completed investments in multiple wind and solar projects, contributing to over 2 gigawatts of renewable energy capacity. Their primary headquarters are in Excelsior, Minnesota, with another office in Portland, Oregon. The firm’s first renewable energy investment fund closed in 2021 with $504 million, surpassing their initial goal.

PROPERTY FACTS

| Sale Type | Investment | Property Subtype | Industrial |

| No. Lots | 1 | Proposed Use | Industrial |

| Property Type | Land | Total Lot Size | 31.52 AC |

| Sale Type | Investment |

| No. Lots | 1 |

| Property Type | Land |

| Property Subtype | Industrial |

| Proposed Use | Industrial |

| Total Lot Size | 31.52 AC |

1 Lot Available

Lot

| Lot Size | 31.52 AC |

| Lot Size | 31.52 AC |

Energy / Battery Storage Portfolio

Description

Energy / Battery Storage Portfolio

Learn More About Investing in Land

1 of 10

VIDEOS

3D TOUR

PHOTOS

STREET VIEW

STREET

MAP