INVESTMENT HIGHLIGHTS

- 41.5 total acres available for purchase.

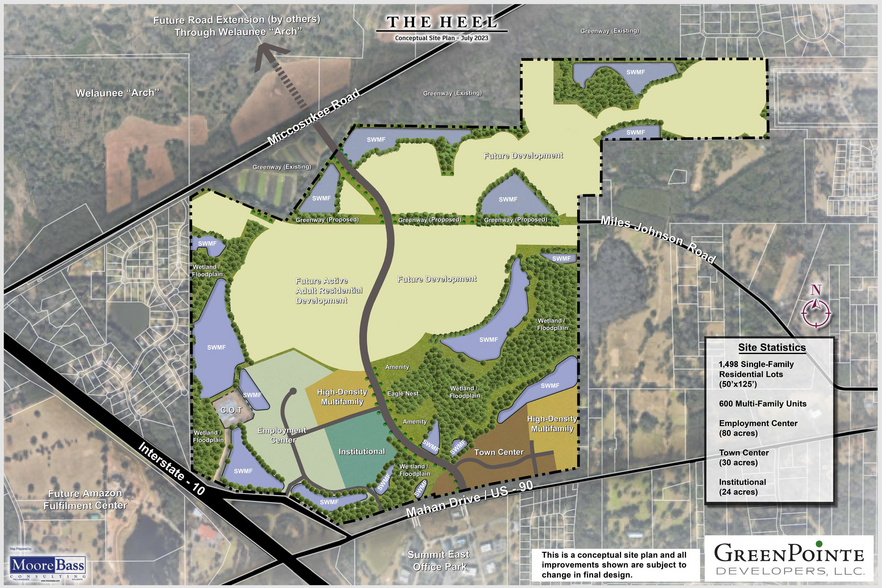

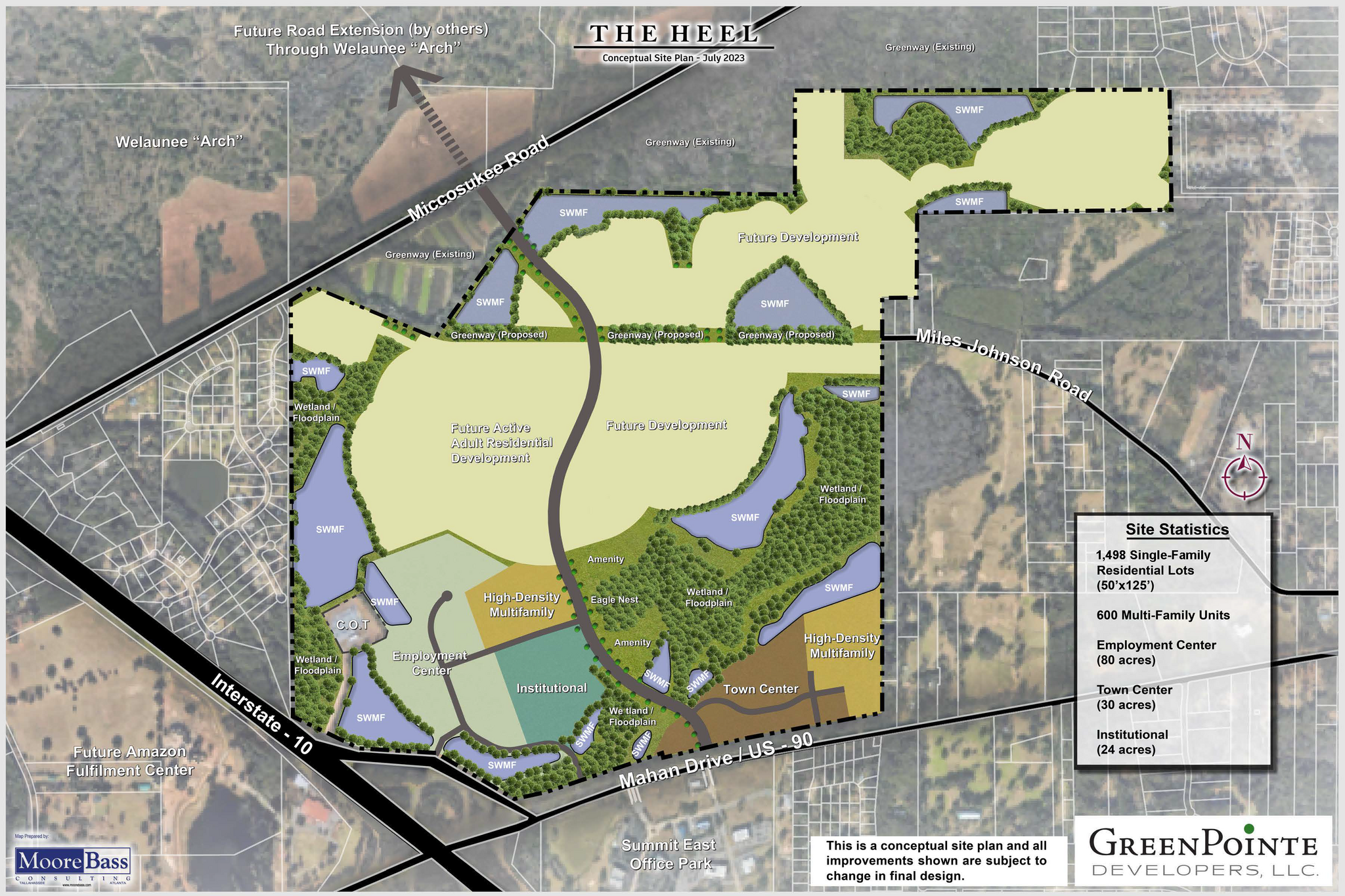

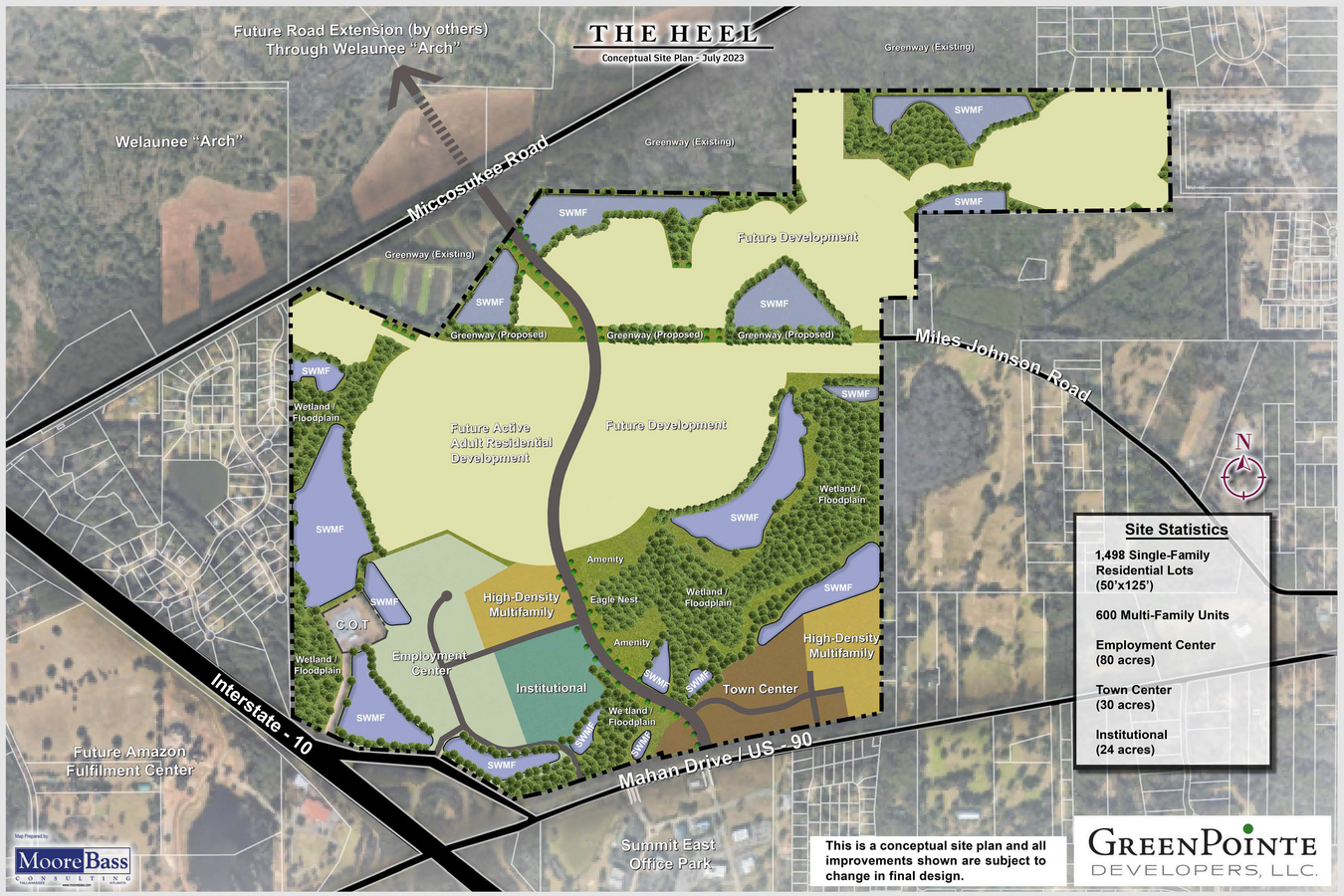

- Entrance to master-planned community with 1,500 single-family homesites, 600 entitled multifamily units, 25 commercial acres & 100-acre business park.

- Sites include multifamily, retail, hotel, grocery, and a gas station.

EXECUTIVE SUMMARY

Approximately 41.5 total acres are available for purchase in the emerging Heel development. The site includes multifamily, retail, hotel, grocery, and a gas station. The residential site will possess the entitlements for up to 300 multifamily units and will be delivered with off-site stormwater allocations and road infrastructure/utilities stubbed to the property line. The retail site(s) will be at the entrance to a master-planned community containing 1,500 single-family homesites, 600 entitled multifamily units, 25+ acres of commercially zoned land, and a 100+ acre business park.

SALE FLYER

PROPERTY FACTS

| Sale Type | Investment |

| Status | Active |

| Number of Properties | 3 |

| Individually For Sale | 3 |

| Total Land Area | 41.50 AC |

PROPERTIES

| PROPERTY NAME / ADDRESS | PROPERTY TYPE | SIZE | INDIVIDUAL PRICE |

|---|---|---|---|

|

The Heel Apartment Site

The Heel, Tallahassee, FL 32317 |

Land | 19.40 AC | - |

|

The Heel Retail Sites

The Heel, Tallahassee, FL 32317 |

Land | 19.20 AC | - |

|

The Heel Gas Station Site

The Heel, Tallahassee, FL 32317 |

Land | 2.90 AC | - |

1 of 1

SALE ADVISOR

Slaton Murray, SIOR, CCIM, Principal / Executive Commercial Advisor

Slaton Murray has been a commercial real estate advisor with NAI TALCOR since his graduation from Florida State University in 2016. He has experience with all the major asset classes but specializes mainly in the acquisition and disposition of investment-grade assets as well as development land. Slaton has taken an active role in the firm’s property management and asset management side of the business which oversees approximately 5,000,000 SF of mainly office, retail, and industrial complexes. Murray holds active brokerage licenses in Florida, Georgia, & Alabama, is a Certified Commercial Investment Manager (CCIM), and is a member of the Urban Land Institute (ULI) as well as the International Council of Shopping Centers (ICSC).