How to Buy an Apartment Complex: From Analysis to Acquisition

Investing in investment properties, such as apartment complexes can be a game changer for real estate investors looking to grow their portfolios. Understanding the fundamentals of multifamily investing can help you maximize these multiple income streams and potential for significant appreciation. These properties offer multiple income streams and potential for significant appreciation. Whether you're a seasoned property owner or a first-time investor, scaling from single unit to multi-unit investments can unlock new opportunities for financial growth.

Step-by-Step Purchase Timeline

Understanding the typical timeline for purchasing an apartment complex helps set realistic expectations and ensure proper preparation at each stage.

| Phase | Duration | Key Activities |

|---|---|---|

| Pre-Search Phase | 4-6 Weeks | • Set investment goals and criteria • Secure loan pre-approval • Research target markets • Build professional team |

| Search & Analysis | 2-3 Months | • Property viewings and initial evaluations • Financial analysis of potential properties • Market comparison research • Submit offers on suitable properties |

| Due Diligence | 30-45 Days | • Property inspections • Financial document review • Title search • Environmental assessments |

| Closing Process | 45-60 Days | • Finalize financing • Review closing documents • Property insurance setup • Final walkthrough and closing |

Typical apartment complex acquisition timeline spanning 6-9 months from initial planning to closing.

Setting Your Goals and Budget

Before diving into apartment complex investments, it's crucial to define your goals and assess your risk tolerance. Are you seeking steady cash flow, long-term appreciation, or a mix of both? Consider your investment timeline and how much involvement you want in property management.

Next, determine your budget by getting pre-approved for a loan. This includes not only the purchase price but also funds for renovations, maintenance, and unexpected expenses. Calculate your potential return on investment (ROI) using tools like a cash on cash return calculator to estimate annual cash flow relative to your initial investment.

Another key metric to consider is the cap rate. This measures a property's potential return regardless of financing. Use capitalization rate to compare different investment opportunities and align them with your goals.

If you're exploring commercial real estate for the first time, learning how to buy a commercial property can provide a solid foundation to guide your decision-making. Whether you ultimately buy a duplex, purchase a triplex, or invest in an even larger building, understanding the different property types and their benefits is a good place to start.

| Metric | Formula | Target Range | Key Insight |

|---|---|---|---|

| Cap Rate | NOI ÷ Property Value | 4-5% (low), 5-8% (average), 8%+ (high) | Higher values indicate better return on property value |

| Cash on Cash Return | Cash Flow ÷ Cash Invested | 4-7% (low), 8-11% (average), 12%+ (high) | Accounts for financing; shows actual return on cash |

| DSCR | NOI ÷ Annual Debt Service | <1.20 (low), 1.20-1.50 (average), >1.50 (high) | Most lenders require 1.25+; higher means lower risk |

Values vary by market location, property class, and economic conditions.

Remember, your budget should account for a down payment (typically 20-30% for apartment complexes), closing costs, and reserves for property improvements and unexpected expenses. By setting clear goals and a realistic budget, you'll be better equipped to find an apartment complex that meets your investment criteria.

Getting Pre-Approved for Financing

Pre-approval provides a clear understanding of your borrowing capacity and strengthens your position as a buyer. Commercial lenders evaluate several factors when pre-approving multifamily loans:

- Credit score and history (typically 680+ for conventional loans)

- Debt-service coverage ratio (DSCR typically 1.25 or higher)

- Available liquid assets for down payment and reserves

- Previous real estate investment experience

Common financing options include:

- Conventional loans: 20-30% down payment, terms up to 30 years

- FHA multifamily loans: Lower down payments but strict property requirements

- CMBS loans: Often used for larger properties, typically $2M+

Pre-approval typically takes 2-3 weeks. Having this in place before property searching helps you move quickly when opportunities arise and shows sellers you're a serious buyer.

Choosing the Right Market

Selecting the right market is crucial for your apartment complex investment. Start by researching local markets and submarkets. Look at population growth, job market trends, and median income levels. These factors can indicate potential demand for rental units.

Analyze market trends by examining historical data on rent prices and occupancy rates. Pay attention to supply and demand dynamics. Are new apartment complexes being built? Is there a shortage of rental units? Understanding these factors can help you predict future market performance.

Evaluate economic growth indicators such as GDP growth, unemployment rates, and the presence of major employers or industries. A diverse economy with multiple growth sectors can provide stability for your investment.

Action steps:

- Use an online real estate database to gather market data

- Contact local real estate agents for insights on market trends

- Review economic reports from local chambers of commerce or government agencies

- Visit potential markets in person to get a feel for the area and its potential

Finding the Right Property

When searching for an apartment complex, it's important to understand the different property classifications:

- Class A: Newer, luxury buildings with high-end amenities

- Class B: Older than Class A, well-maintained with some amenities

- Class C: Older buildings, may need repairs, fewer amenities

- Class D: Outdated properties often requiring significant renovation

Choose a class that aligns with your investment goals and budget. When evaluating properties, consider:

- Amenities

- Property condition

- Renovation potential

- Location

Apartment Buildings For Sale

Conducting Due Diligence

Thorough due diligence on a multifamily asset is crucial before finalizing your investment. This process involves several key steps:

- Financial analysis: Review income statements, expense reports, and tax returns. Use an NOI Calculator to determine the property's profitability.

- Conduct a break-even analysis to find the minimum occupancy you'll need to generate profit.

- Property inspections: Hire professionals to assess the building's condition, including structural, electrical, and mechanical systems.

- Legal review: Examine leases, permits, and zoning regulations.

- Financial metrics: Calculate key ratios like the gross rent multiplier to evaluate the property's value.

- Commercial real estate appraisal: Obtain a CRE appraisal to get a professional valuation of the property.

Making an Offer and Negotiating

Successful apartment complex negotiations require strategy and preparation. Start by determining your maximum purchase price based on your financial analysis and pre-approval amount.

Key Negotiation Points

- Purchase price adjustments based on inspection findings

- Seller financing or earnest money terms

- Property improvements before closing

- Existing tenant lease transfers

- Due diligence period length

- Closing timeline and occupancy date

Offer Structure

Include these key elements in your offer:

- Property price and payment terms

- Proof of funds or pre-approval letter

- Contingencies for financing, inspection, and appraisal

- Proposed closing date

- Required documentation timeline

Submit your initial offer at 10-15% below asking price to leave room for negotiation, but ensure it's supported by your market analysis and comparable sales data. Be prepared to demonstrate how you arrived at your offer price using concrete financial metrics and market comps.

Financing Options

Securing the right financing is crucial when purchasing an apartment complex. Several options are available to investors:

- CRE loans: These are specifically designed for commercial properties and often offer competitive rates and terms.

- Conventional mortgages: Similar to residential mortgages but typically with stricter requirements and higher down payments.

- Private money lending: Involves borrowing from individuals or private companies, often with higher interest rates but more flexible terms.

- Crowdfunding: Allows multiple investors to pool resources to finance a property, potentially lowering individual capital requirements.

Managing Your Investment

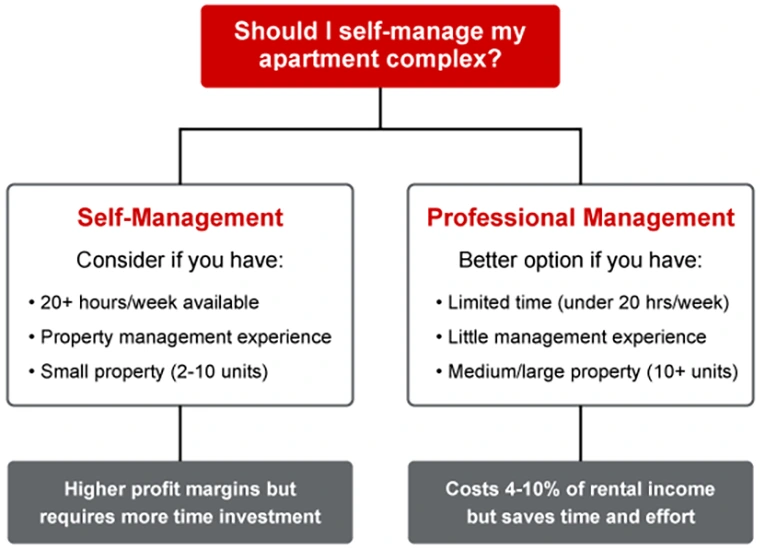

Effective management is crucial for the success of your apartment complex investment. You have two main options: self-management or hiring a property management company.

Apartment Management Decision Tree

Management Options

Self-management can save costs but requires significant time and expertise. Hiring a property management company can provide professional expertise and free up your time, but it comes with additional expenses.

Working with a Property Management Company

If you choose to hire a management company:

- Research their track record and client reviews

- Ensure they have experience with similar properties

- Clarify their fee structure and services provided

- Establish clear communication channels and reporting processes

Tenant Management

Successful tenant management is key to your property's performance. Learning how to screen tenants effectively can help you find reliable, long-term renters. Additionally, understanding how to find good tenants through targeted marketing and networking can reduce vacancy rates and turnover costs.

Frequently Asked Questions (FAQ)

How do I calculate the potential cash flow from an apartment complex investment?

Calculate cash flow by subtracting all operating expenses and debt service from the total rental income. Use tools like the NOI calculator, cash-on-cash return calculator, and cap rate calculator to assess potential returns. Consider factors such as vacancy rates, maintenance costs, and property management fees in your calculations.

What are the key differences between investing in single-family rentals and apartment complexes?

Apartment complexes typically offer economies of scale, multiple income streams, and potentially higher returns. However, they require larger initial investments, more complex management, and different financing options. Single-family rentals are often easier to buy and manage but may have higher per-unit maintenance costs and greater vacancy impact.

How can I mitigate risks when investing in an apartment complex?

Mitigate risks by conducting thorough due diligence, diversifying your tenant base, maintaining adequate cash reserves, implementing effective property management, staying informed about market trends, and having a solid insurance coverage. Regular property maintenance and updates can also help maintain property value and attract quality tenants.

Closing Thoughts

Investing in apartment complexes offers significant potential for both first-time buyers and experienced property owners looking to scale their portfolios. Understanding how to buy a multifamily property is crucial for success, whether you're just starting out or expanding your real estate holdings. Take the next step by exploring apartment buildings for sale in your target markets.