Exit Cap Rates in Commercial Real Estate

What is an Exit Cap Rate?

An exit cap rate (also known as a terminal cap rate) is the projected capitalization rate used to estimate a property's future selling price at the end of your investment period. This critical metric helps investors forecast potential returns and plan their exit strategies.

While traditional approaches simply add a fixed percentage to the entry cap rate, today's market conditions require a more sophisticated analysis.

Think of an exit cap rate as your crystal ball for property valuation. It represents the relationship between a property's expected net operating income and its anticipated sale price at the time you plan to sell.

Traditional static approaches to exit cap rates often fall short because they fail to account for changing market conditions, evolving property characteristics, and shifting investor preferences. For example, adding a standard 0.5% to your entry cap rate doesn't consider factors like neighborhood development, property improvements, or economic cycles.

A dynamic exit cap rate strategy considers multiple variables:

- Market cycle positioning

- Property performance trends

- Local economic indicators

- Asset class evolution

- Capital markets conditions

This modern approach leads to more accurate valuations and better-informed investment decisions. By understanding how these factors interact, investors can develop more reliable exit strategies and maximize their potential returns.

How Do Exit Cap Rates Work?

Exit cap rates help investors estimate a property's future value at sale. They reflect the relationship between a property's expected net operating income and its anticipated sale price. Understanding this relationship is crucial for evaluating potential returns and making informed investment decisions.

Exit Cap Rate Formula

For example, if an investor expects their property to generate $500,000 in net operating income at sale and they estimate a 6% exit cap rate based on market conditions, they can project a future value of approximately $8.33 million.

Determining Your Exit Cap Rate

Today's market requires careful consideration when selecting your exit cap rate. Most investors start with the current market cap rate for similar properties and adjust based on:

- Expected market conditions at sale

- Property age and condition forecast

- Anticipated competitive properties

- Future supply and demand projections

Understanding your exit cap rate helps with commercial property valuation and shapes your investment strategy. It provides a framework for evaluating potential returns and determining optimal hold periods.

How Do Entry and Exit Cap Rates Differ?

Your going-in cap rate reflects today's market conditions, while your exit cap rate anticipates future market conditions. The going-in cap rate is calculated using your initial net operating income divided by your purchase price. For development projects, investors often compare this with yield on cost to evaluate whether to build or buy existing properties.

Why Exit Cap Rates Are Usually Higher

Exit cap rates often exceed entry cap rates to account for future market uncertainty and property aging. For example, a property purchased at a 5% cap rate might use a 6% terminal cap rate for a five-year hold period.

This relationship affects your commercial property valuation in two key ways:

- Higher exit cap rates lead to lower projected sale prices

- Conservative exit assumptions help protect against market downturns

Real Market Example

Consider a multifamily property purchased in 2023 for $10 million with a $500,000 NOI (5% entry cap rate). If you project a $600,000 NOI in 2028 and use a 6% exit cap rate, your estimated sale price would be $10 million ($600,000 ÷ 0.06). Despite the higher NOI, the increased exit cap rate offsets potential value appreciation.

This conservative approach helps investors:

- Set realistic return expectations

- Build in a margin of safety

- Account for property depreciation

How Do Market Conditions Impact Exit Cap Rates?

Market location significantly influences exit cap rates in CRE investment. Primary markets typically maintain lower exit cap rates due to stronger demand and economic stability. Secondary markets often require higher exit cap rates to account for increased risk and market volatility.

Asset Class Variations

Different property types carry distinct risk profiles and exit cap rate expectations:

- Apartment buildings typically maintain the most stable exit cap rates due to consistent housing demand

- Industrial properties show strong performance driven by e-commerce growth

- Office space exit cap rates reflect evolving workplace trends

- Retail space varies significantly by location and format

Local Market Factors

Commercial real estate evaluations consider several local factors when determining exit cap rates:

- Population and job growth trends

- Infrastructure development plans

- Local regulatory environment

- Supply pipeline in your submarket

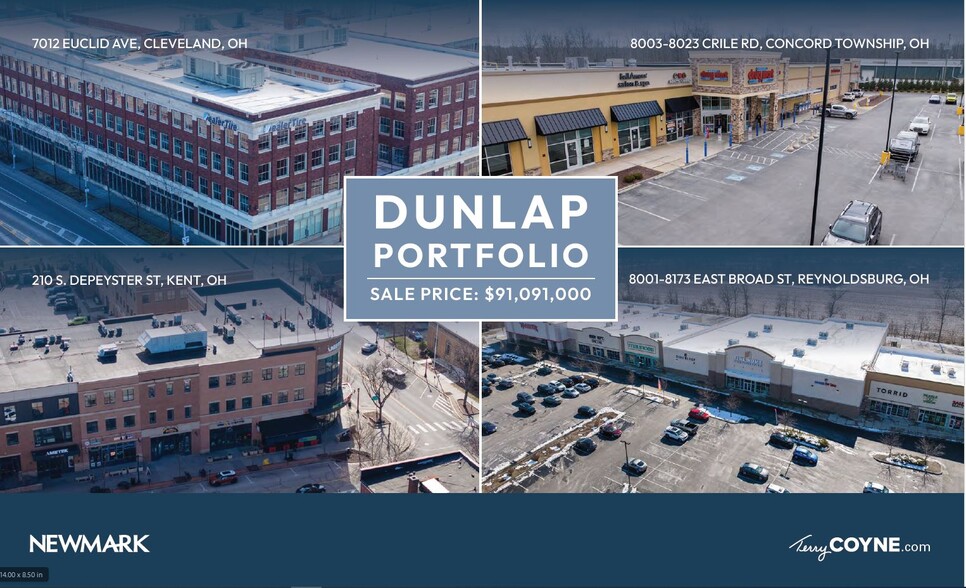

Here are active listings in your area that demonstrate how these different property types are currently being valued:

Commercial Properties For Sale

How Does the Economy Affect Exit Cap Rates?

Exit cap rates are directly impacted by three key economic factors: interest rates, inflation, and economic cycles. Higher interest rates typically lead to higher exit cap rates because increased borrowing costs reduce property values. This relationship means that interest rate changes can influence exit cap rates.

- Interest Rates: Exit cap rates tend to move in parallel with interest rates because A influences B

- Inflation: High inflation periods often lead to exit cap rate expansion because rising costs affect property values

- Economic Cycles: Market timing influences terminal values because buyer demand shifts throughout cycles

Consider these economic conditions when setting your exit assumptions:

- Rising Rate Environment: Higher Exit Cap Rate

- Peak Market Cycle: More Conservative Exit Cap Rate

- Strong Economic Growth: Potential Cap Rate Compression

Smart investors adjust their exit cap rate assumptions based on economic forecasts for their anticipated sale year. This dynamic approach helps protect against market volatility and maximizes potential returns.

How Does Property Age Affect Exit Cap Rates?

Property age and condition directly influence exit cap rates because newer properties command lower cap rates. Understanding property lifecycle stages helps investors optimize renovation timing and exit strategies. Strong DSCR in real estate performance supports value-add improvements that can lower exit cap rates.

Property Age Impact on Terminal Value

- Newer Properties: Lower Exit Cap Rates because they require less maintenance

- Aging Properties: Higher Exit Cap Rates because future capital expenses increase

- Renovated Properties: Adjusted Exit Cap Rates because improvements reset property age

Value-Add Strategy Effects

Strategic renovations may lead to lower exit cap rates because they increase property competitiveness. To evaluate renovation impact, investors should calculate DSCR for rental property performance both pre and post-improvement.

Optimal renovation timing consists of three key factors:

- Market Cycle Position: Determines renovation ROI

- Property Performance: Influences improvement urgency

- Capital Availability: Affects scope of renovations

Properties with well-timed improvements achieve better exit cap rates because they attract higher-quality tenants and command stronger rents. This relationship between property condition and cap rates drives value-add investment strategies.

How Do You Manage Exit Cap Rate Risk?

Market cycles can influence exit cap rates through changes in property values and investor demand. While exit cap rates focus on terminal value, other metrics like calculating cash on cash return can help evaluate overall investment performance.

Market Cycle Considerations

- Economic Growth: Can affect property values and demand

- Interest Rate Environment: Influences buyer behavior

- Supply and Demand: Impacts property values over time

Asset Class Considerations

Different property types may have varying exit cap rates based on their characteristics and market conditions. The gross rent multiplier can provide additional context when analyzing property values.

Factors That May Trigger Strategy Review

- Interest Rate Changes: May affect property valuations

- Market Fundamental Shifts: Could impact demand patterns

- New Supply Pipeline: May influence local market dynamics

Regular monitoring of these factors can help investors adjust their exit strategies as market conditions change.

When Should You Adjust Your Exit Cap Rate Assumptions?

Exit cap rate assumptions may need adjustment when significant market changes occur.

Market Changes That May Warrant Review

- Interest Rate Movements: Consider impact on future buyer financing

- Local Market Changes: Monitor supply and demand shifts

- Property Performance: Track operational changes

Portfolio Considerations

Different properties within a portfolio may require different exit cap rate assumptions based on their characteristics:

- Property Type: May influence timing of exit

- Location: Can affect future buyer pool

- Age and Condition: Could impact future capital requirements

Hold or Sell Framework

When evaluating hold/sell decisions, consider:

- Current Market Conditions: Compare to your original exit assumptions

- Property Performance: Evaluate against market benchmarks

- Capital Markets: Assess availability of buyer financing

Regular review of these factors can help inform timing decisions for property dispositions. Each property's specific circumstances should guide the ultimate hold/sell decision.

Frequently Asked Questions About Exit Cap Rates

What's the relationship between exit cap rates and property improvements?

Strategic improvements can lead to lower exit cap rates by increasing property competitiveness and tenant demand. Consider strategies for repurposing office properties to enhance value and potentially reduce your exit cap rate.

How do different financing structures impact exit cap rates?

Financing terms through CRE loans can affect buyer pool size and property marketability at exit. Conservative leverage typically supports lower exit cap rates by reducing buyer financing risk.

How Will Environmental and Sustainability Standards Impact Future Exit Cap Rates?

Properties meeting modern environmental and sustainability standards, such as LEED certification, may achieve lower exit cap rates. Buildings with poor energy efficiency or outdated environmental features could require higher exit cap rates to account for necessary future upgrades.

What Technology Features Will Affect Property Valuations?

Smart building systems and modern digital infrastructure may support lower exit cap rates. Properties lacking current technology could require higher exit cap rates to account for future modernization costs.