How to Buy Land: Key Steps for Land Acquisition

Entering the world of land ownership is a pivotal decision that can redefine your commercial real estate investing portfolio. This guide equips you with insights for mastering the commercial land acquisition process.

Is Buying Land a Good Investment?

Short answer, it depends.

Developing areas can offer property value appreciation, while vacant land can provide a safety net in volatile markets. However, land investments come with risks like zoning restrictions, environmental challenges, and market downturns. If you're exploring broader opportunities in real estate, understanding how to buy commercial property can provide a foundation for evaluating diverse investment options.

Weighing the Pros and Cons of Buying Land

Before moving forward with your land purchase, it's essential to understand the pros and cons of buying land. While owning undeveloped land can offer customization flexibility and long-term appreciation, it also comes with challenges like securing financing and dealing with zoning issues. Knowing these factors can help you make an informed decision that aligns with your investment goals.

| Benefits of Land Investment | Challenges of Land Investment |

|---|---|

| Appreciation Potential: Land in developing areas can significantly increase in value over time | Financing Difficulties: Land loans typically require higher down payments (30-40%) and have stricter terms than building loans |

| Customization Flexibility: Ability to build exactly what your business needs without compromise | Zoning Restrictions: Local regulations may limit what can be built or how the land can be used |

| Limited Supply: Land is a finite resource that cannot be manufactured, creating inherent value | Development Costs: Infrastructure development (utilities, access roads) can be expensive and time-consuming |

| Stability in Volatile Markets: Vacant land can maintain value even during market downturns | Environmental Challenges: Issues like soil contamination, flood plains, or protected habitats may restrict development |

| Lower Maintenance Costs: Undeveloped land requires minimal upkeep compared to improved properties | Limited Income Potential: Raw land typically generates no income until developed |

| Tax Benefits: Potential property tax advantages for agricultural or conservation use | Long Investment Timeline: May require 3+ years before seeing returns on investment |

Should You Buy Commercial Land?

When Land Purchase Makes Sense

Before investing in raw land, evaluate your situation. Land purchase is optimal when:

- Your commercial project requires specific features unavailable in existing properties

- You need exact dimensions or layouts for specialized operations

- Long-term appreciation potential outweighs immediate income needs

- Your capital timeline allows for 3+ years of development

- You have 30-40% of the total project budget in liquid capital

Quick Assessment Tool

Rate your readiness (1=No, 3=Partially, 5=Yes):

- Can you cover predevelopment costs for 24+ months?

- Do you have relationships with commercial lenders?

- Have you confirmed zoning allows your intended use?

- Is your project financially viable even with 20% higher development costs?

- Have you validated infrastructure costs with local utilities?

Total Score:

- 20-25: Ready to proceed

- 15-19: Address gaps first

- Below 15: Consider existing commercial properties

Budgeting and Financing for Land Purchase

Understanding the details of land loans plays a crucial role in the financial planning of your commercial land purchase. Early calculations must include not only the purchase cost but also the expenses tied to securing professional services and developing necessary infrastructure. It's just as important to account for the long-term financial responsibilities, from taxes and insurance to regular maintenance.

Land Appraisals: Determining the True Value of Land

Before finalizing your land purchase, it's essential to get an accurate understanding of the property's market value. A professional land appraisal provides an unbiased assessment, helping you avoid overpaying and ensuring your investment aligns with its true worth. Whether you're securing financing or planning future development, understanding the value of the land through a comprehensive appraisal can protect your investment and guide your decision-making process.

Finding the Right Plot of Land

Finding the ideal plot for your commercial project is all about smart planning and getting the right help. Working with real estate agents who know the commercial market can speed up your search and give you access to properties that aren't listed publicly. For the widest selection of land for sale and easy-to-use search tools, LoopNet.com is your go-to source, recognized as the largest online marketplace for commercial real estate. Don't overlook public land auctions either; they're a great source of land that could potentially be purchased at a good price.

Remember, the right land does more than just sit in a good spot or come at a good price. It should fit your business goals and pass all zoning regulations. Doing your homework and having a solid plan is key to making the right choice for your investment.

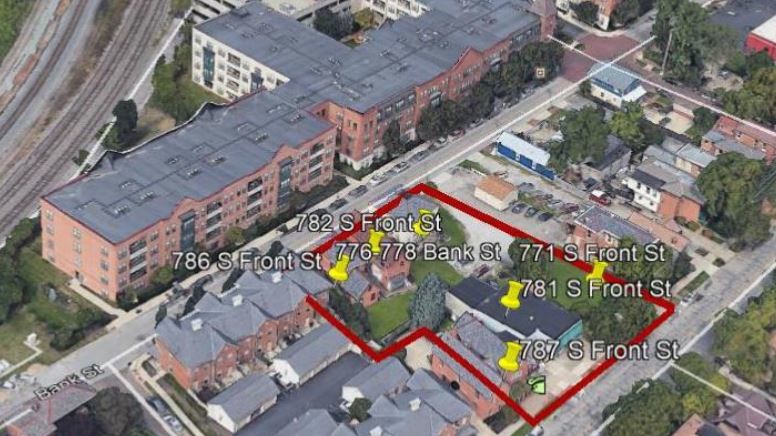

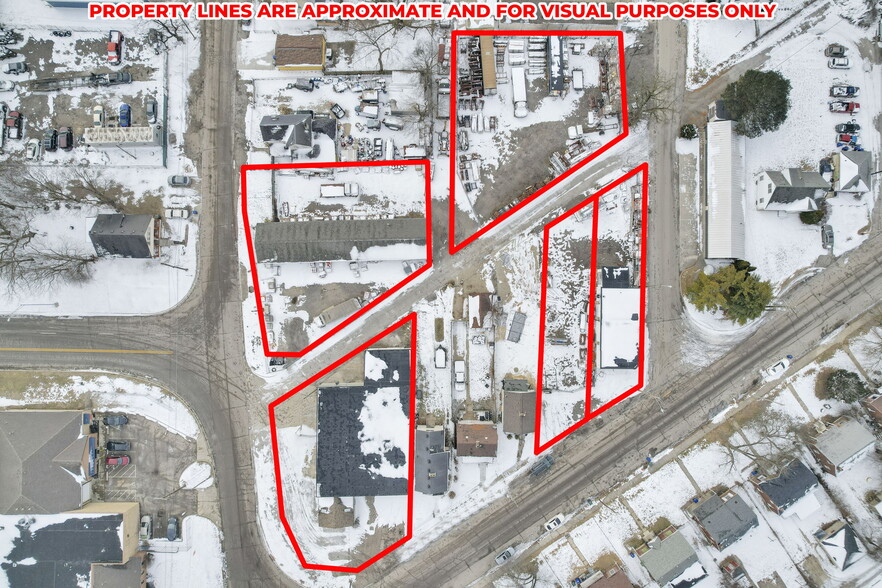

Land For Sale

Questions to Ask When Buying Land

Before investing in land, understanding its potential, current condition, and crucial factors is paramount in ensuring a successful and beneficial deal. Here are essential considerations and questions you should keep in mind:

What are my plans for the land? Do I intend to build on it or hold it for future resale? If I plan to build, what factors will impact my ability to develop the land, such as zoning regulations, environmental concerns, and accessibility? If I plan to resell, what potential resale value can I expect based on the land's location, zoning, and potential uses?

What is the location's potential impact on land value? Are we looking at a well-established area with low-risk prospects but limited growth potential, or an emerging location with higher risks but potential for exponential returns if the area experiences growth?

What are the potential future uses for the land? How might the location's current and future developments impact its potential use, such as an influx of businesses leading to a demand for residential property and opportunities for multi-unit developments?

Are there other revenue streams I should consider? Are there any potential revenue sources beyond traditional land development that I should explore, such as mineral rights, timber value, or renewable energy production? How might these alternative revenue streams impact the land's overall value and potential returns on investment?

What access and utility considerations should I make? What are the land's legal access options, such as public roads or deeded easements, and are they sufficient for my needs? Are the critical services like electricity, sewage, and water available and accessible on the site?

What survey and neighbor information do I need? Has a recent survey been conducted on the land, and are the boundary lines clearly marked? What do I need to know about the adjoining neighbors, and are there any ongoing property disputes that could impact my investment?

Land Sustainability Assessment

Before finalizing a transaction, conduct a thorough land suitability assessment to ensure the land meets your business's operational demands. This includes:

- Comprehensive soil testing and environmental checks to determine the land's capacity for construction and potential remediation needs.

- Hazard assessments to identify risks related to natural disasters, such as flooding, landslides, and geotechnical concerns.

This information is crucial for ensuring project safety, sustainability, and long-term value protection, as well as for insurance considerations.

Understanding Land Zoning Rules and Regulations

Zoning is crucial for investors because it directly impacts land value and dictates what the land can be used for. A solid understanding of land zoning helps ensure your investment aligns with your goals and avoids unexpected limitations. Staying informed about zoning regulations can safeguard against potential issues that could affect your property's future use and value.

| Zoning Category | Primary Uses | Key Restrictions | Value Implications |

|---|---|---|---|

| Commercial | Retail stores, offices, restaurants, service businesses, hotels | Building height limits, parking requirements, signage limitations, operating hours | Generally higher value in high-traffic areas; value directly tied to location and access |

| Industrial | Manufacturing, warehousing, distribution centers, research facilities | Environmental regulations, noise limitations, loading/unloading requirements, hazardous material storage | Value based on proximity to transportation infrastructure; typically lower per-square-foot value than commercial |

| Residential | Single-family homes, multi-family units, apartments, condominiums | Density restrictions, minimum lot sizes, setback requirements, height limitations | Value affected by neighborhood quality, school districts, and proximity to amenities |

| Mixed-Use | Combination of residential, commercial, and sometimes light industrial in a single development | Proportional use requirements, design standards, public space allocations | Often higher value potential due to flexibility; increasingly favored in urban planning |

| Agricultural | Farming, ranching, forestry, equestrian facilities | Limited residential density, restrictions on non-agricultural commercial use, subdivision limitations | Generally lower per-acre value; potential for tax benefits; long-term appreciation if near expanding urban areas |

| Special Purpose | Airports, educational institutions, healthcare facilities, historic districts | Highly specific use limitations, additional regulatory oversight, special permitting requirements | Value highly dependent on specific allowed uses; may require specialized appraisal methods |

Land Entitlement

Land entitlement determines how a property can be used and what can be developed on it. This legal process requires approval from local authorities and is essential for ensuring your project aligns with zoning regulations and community standards. Understanding the importance of land entitlement can help you avoid costly delays and maximize the value of your investment.

Making an Offer and Negotiating

When the time comes to transition from due diligence to action, understanding how to make an offer when buying land is your next critical step. A crafted written offer lays the groundwork for what you're willing to pay and the terms of the deal, serving as the formal gesture of your intent to purchase. In this document, you'll outline not only your proposed price but also various terms and conditions that the seller will consider.

In negotiations, knowledge is power. Having a solid grasp of the land's fair market value, driven by scrutinizing comparable sales in the area, arms you with the leverage necessary to negotiate effectively. You want to enter these discussions with the confidence and data needed to make reasonable yet favorable terms for your investment.

A savvy commercial real estate investor never overlooks the importance of contingencies-these are the conditions that must be satisfied before you fully commit to the transaction. Whether it's verifying zoning compatibility, confirming the result of environmental tests, or ensuring accuracy through a land survey, contingencies are your strategic safety net to minimize risk.

As each component of an offer has considerable impact on the deal's outcome, a detailed understanding of negotiating tactics and contractual elements is invaluable.

Due Diligence and Closing the Deal

Title Search and Legal Consultation

A comprehensive title search confirms that the land is free from legal encumbrances and clear for sale. You should review the grant deed to understand its limited warranties and ensure the conveyance is valid. For complex deals or when inconsistencies arise, enlisting a real estate attorney can provide crucial guidance and peace of mind.

Understanding the Land Purchase Agreement

The land purchase agreement is the official record of the sale's terms, from price and payment plans to any contingencies. Ensure you understand every clause, as this contract protects your rights as the buyer and outlines any remaining obligations.

Finalizing the Transaction

At closing, review all documentation thoroughly and confirm all outstanding conditions are satisfied. Only then should you proceed with signing, which formally concludes your acquisition and transfers ownership.

Post-Purchase Considerations

After your land purchase, it's time to get it ready for use. This means sorting out utilities, building roads, or getting the right legal permissions for access, all tailored to your type of property, whether that's commercial real estate, multifamily, retail, industrial, office, hospitality, or residential income projects. Next up is planning your construction project, making sure it lines up with what the market needs right now. Working together with architects, builders, and local officials will help make your plans clear and keep your project on track, turning your investment into something real and profitable.

Disclaimer: This article is for informational purposes only and is not intended as professional financial advice. While we strive to provide useful information, we advise seeking counsel from experts. Reliance on any information in this article is at the discretion of the reader.