Lien Waivers in Commercial Property Investment

What is a Lien Waiver?

A lien waiver is a written contract renouncing the right to lien a property after receiving payment.

In the construction industry, lien waivers ensure smooth transactions and prevent disputes over payment. When issued, they confirm that the contractor has received satisfactory payment and renounces future lien claims against the property. This instrument provides protection for property owners and helps conclude real estate projects smoothly.

What is a Lien on a Property?

A lien is a legal claim or security interest over a property, often used to secure the repayment of a debt or obligation. In commercial real estate, liens often come into play in construction projects. A contractor, subcontractor, or supplier may file a mechanic's lien, also known as a construction lien, against the property if they've not received payment for services or materials supplied.

Liens can act as financial roadblocks for property owners, impairing their ability to sell or refinance the property. They can also affect their ability to secure commercial real estate loans due to the outstanding debt. A lien can lead to forceful recovery of the debt through the sale of the property. Additionally, common areas maintenance charges can be managed more effectively using lien waivers, ensuring timely payments and minimizing disputes.

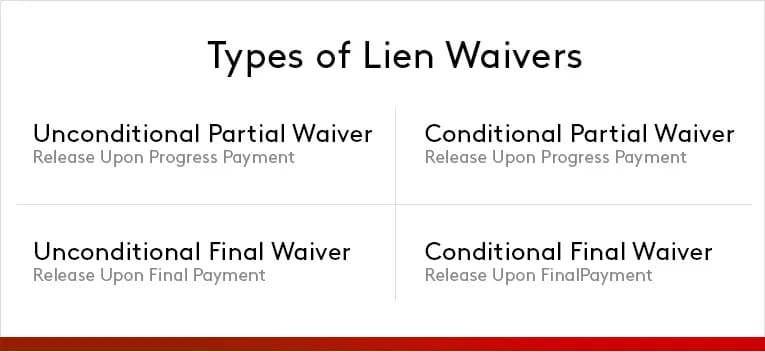

Types of Lien Waivers

Mastering commercial property investment involves understanding the different types of lien waivers that are applicable at various stages of development. Each waiver has its unique specifications and knowing when to apply them can help ensure a smooth process.

Unconditional Lien Waiver and Release Upon Progress Payment

This type of lien waiver is a confirmation of payment received and relinquishes all rights to place a lien for the specified amount up to the date mentioned in the waiver. It is perceived as the safest option for property owners as it clearly indicates no future lien claims will arise for the amount paid. However, contractors need to ensure that they have received the payments before issuing this waiver.

This waiver is beneficial to use when payments are cleared on time during the progress of the project. It offers security to the property owner and confirms the contractor has been paid up to the stated timeline.

Conditional Lien Waiver and Release Upon Progress Payment

Unlike the unconditional waiver, this lien waiver is dependent on the actual payment being processed and received. The waiver becomes valid only on meeting this condition. It offers protection to the contractors against any payment issues after the waiver is issued.

Contractors could opt for this waiver when they have not yet received the payments. It guarantees that they do not unintentionally give up their rights before receiving the payment.

Unconditional Lien Waiver and Release Upon Final Payment

This lien waiver indicates that the contractor has been fully paid for their services and will not assert a right to lien on the property, regardless of the circumstances. Like the unconditional waiver on progress payment, it provides maximum security to the property owner.

This waiver is suitable at the end of the project when the final payment has been received.

Conditional Waiver and Release Upon Final Payment

This final type of lien waiver certifies that the lien rights against the property for the contracted work are released, provided the contractor has received the final payment. It becomes valid only after the final payment is cleared.

This waiver is recommended when the final project payment is still pending. It ensures the contractor does not forfeit their lien rights before getting the final payment.

The Role of Lien Waivers in Commercial Real Estate

Lien waivers are indispensable tools in commercial real estate investing, serving as key risk mitigation instruments. In the challenging landscape of property investment, they offer a level of security.

Construction and Development Phases

In property development, and particularly in situations involving triple net lease arrangements, lien waivers act as a safeguard against payment disputes. Especially in situations such as a ground lease, where improvements are often made to the property, lien waivers play a crucial role. By providing clear proof of what was paid, when, and for what, they help prevent future disagreements and foster a smoother process.

Risk Mitigation

The real magic of lien waivers lies in their ability to shield against "double payment" scenarios. Without them, unpaid subcontractors could file a lien against the property even if the property owner has paid the general contractor, leading to potential double payments. Lien waivers halt such occurrences.

Lien waivers also uplift investor confidence. They ensure the property remains unburdened with liens, which is crucial in maintaining its market value and increasing its appeal in the commercial real estate market, as well as positively affecting its commercial real estate appraisal.

Lien waivers help streamline payment operations during construction, prevent double payment issues, and increase a property's attractiveness to investors, an essential trio in successful commercial property development.

What is a Lien Waiver in Construction?

A lien waiver in construction is essentially a written agreement signed by a contractor, subcontractor, or supplier, where they renounce their right to file a mechanic's lien against a property once they've received payment for their work.

Step by Step Lien Waiver Process

STEP 1: Completion of Services: A lien waiver comes into place once a service is completed by a contractor, subcontractor, or supplier.

STEP 2: Verification of Completion: The property owner or general contractor verifies the completion of the provided services. This verification is crucial as it forms the basis of the lien waiver agreement.

STEP 3: Issuance of Lien Waiver: Once the work is completed and verified, the contractor or subcontractor issues the appropriate lien waiver. They should carefully consider whether a conditional or unconditional waiver is most suitable, based on whether payment has been received or is still pending.

STEP 4: Receiving the Payment: Upon receiving a lien waiver, the property owner or general contractor releases the agreed payment. Often, they may withhold payment until the waiver is signed and delivered to them, safeguarding against unnecessary lien issues in the future.

STEP 5: Filing the Lien Waiver: Finally, retain a copy of each signed lien waiver for future reference and as evidence of payment, thus closing the circle of this process.

The Legal Nuances

Lien waivers are not universally regulated, and laws vary significantly from state to state. Some states have specific forms and language requirements, while others are more lenient.

It’s also important to understand how the type of deed used in a transaction can affect lien exposure. A grant deed typically guarantees that the seller owns the property and that it is free of undisclosed liens. A specialty warranty deed only covers the period of the seller’s ownership, leaving the buyer responsible for any earlier claims. In contrast, a quitclaim deed makes no guarantees about title and can carry the highest risk of inherited liens. Understanding these deed types helps investors evaluate potential lien complications more clearly.

In states that legislate lien waivers, like California or Texas, using the wrong form can result in an invalid waiver. In states without strict regulations, you may encounter various lien waiver documents, which can be both beneficial and problematic.

Always read and understand each lien waiver document before signing. Be cautious about the type of waiver, whether conditional or unconditional, and ensure the terms are fulfillable. Once signed, a lien waiver can legally affect your right to claim a debt, so proceed with caution.

Browse Commercial Properties for Sale

Now that you've deepened your understanding of commercial real estate investing with insights into lien waivers, you're well-equipped to take the next step. Explore available opportunities tailored to your investment goals. Browse our listings of properties for sale to find the perfect investment opportunity for you.

Commercial Real Estate For Sale