The Difference Between Usable Square Feet and Rentable Square Feet

As an owner of an office building, it's crucial to understand and accurately calculate the difference between Usable Square Feet (USF) and Rentable Square Feet (RSF).

USF refers to the actual office space a tenant occupies. In contrast, RSF accounts for the tenant's share of the building's common areas, such as hallways, stairwells, lobbies, and restrooms.

Properly calculating and communicating these figures ensures transparency with your tenants and optimizes your leasing strategy.

Consider a scenario where your office building spans 100,000 square feet, with 15,000 square feet designated as common areas accessible to all tenants. This configuration establishes a common area factor of 15%. Understanding and managing this factor is key to optimizing the financial performance of your property.

For example, if a specific tenant's USF totals 20,000, the rent calculations will include the 15% common area factor, bringing the RSF to 23,000. This accurate calculation ensures that you fairly charge for every square foot, including shared spaces.

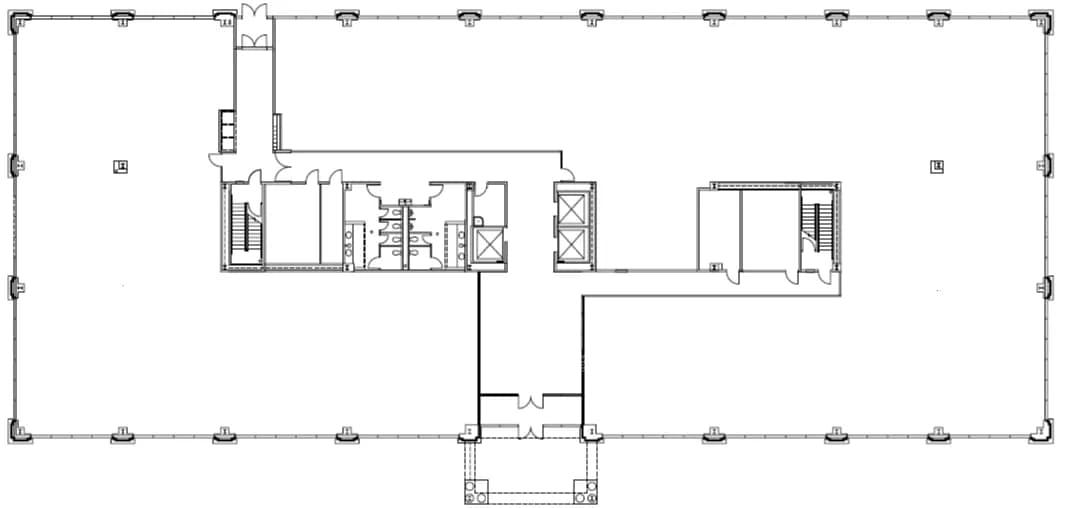

A floorplan of an office building illustrating that 15% of the space is allocated to common areas-such as hallways, restrooms, lobbies, and stairwells-highlights how effectively the property's space is utilized, leaving 85% as directly leasable area. Such visual aids can be invaluable in discussions with prospective tenants and for internal reviews of space efficiency.

In the example discussed, if the rate is set at $20.00 per RSF annually, leasing out the 23,000 RSF-rather than just the 20,000 USF-increases your annual revenue to $460,000, or approximately $38,333 per month. This calculation highlights the significant financial benefit of accounting for the common area factor in your lease agreements, ensuring that every square foot contributes to your building's profitability.

Please note that these example calculations are considered best practices, but may not be used as a guide by all landlords in all cities.

About the Author: Beth Young

Beth Young serves as Senior Vice President of Colliers International in Houston, Texas. She develops and executes acquisition, disposition and leasing strategies for investors and users of healthcare and office real estate. She serves as Trustee of the Harris County Hospital District Foundation, Director of the Greater Houston Women's Chamber of Commerce and Chairman of the Women's Health Network of the Texas Medical Center.

This article was updated on 12/12/2024