What is a Ground Lease? A Breakdown for Commercial Real Estate

Unlocking the world of commercial real estate investing begins with a clear understanding of its varied financing strategies. A crucial piece of that puzzle is the ground lease. Deceptively simple, a ground lease serves as a powerful tool in leveraging real estate holdings and streamlining business growth.

This article goes into the intricacies of ground and land leases, from their fundamental workings to financing considerations, expiration nuances, and the ownership stakes in leased-land properties. In some cases, these leases may also include a right of first offer clause, giving tenants priority to buy the land before it’s marketed to others.

What is a Ground Lease?

A ground lease is a long-term contract between a landowner and a tenant, allowing the tenant to develop the land and build structures on it while paying rent and other expenses. Typically spanning 50 to 99 years, ground leases enable tenants to use prime locations without purchasing the land. At the end of the lease, any improvements made revert to the landowner unless otherwise negotiated.

Key Takeaways

- Long-Term Arrangements & Development Rights: Ground leases are long-term deals (typically 50-99 years) that provide tenants the right to develop and improve a parcel of land without owning it.

- Tenant's Responsibilities & Benefits: In a ground lease, tenants handle significant liabilities such as rent, taxes, construction, and property management. However, they also gain the advantage of accessing prime locations without hefty initial investment.

- Reversion of Improvements: Although tenants make improvements, ownership of these enhancements reverts to the landlord at the lease's end, unless an extension or renewal is agreed upon.

- Finance and Lease Assignment Complications: Financing buildings on leased land can get complex, particularly if the lease is subordinated. Lease assignment, which allows lease obligations transfer, is another intricate but essential aspect often overlooked in ground leases.

Ground Leases vs Land Leases

Ground leases and land leases are commonly leveraged in commercial real estate to maximize land utilization and financial gain from property without selling it outright. These lease types provide a framework for property development, serving as a bridge between landowners and developers.

Key features include:

- Lease Length: Typically 50–99 years, ground leases provide stability for tenants and long-term income for landlords.

- Tenant Responsibilities: Tenants handle all property-related expenses, including taxes, insurance, and maintenance.

- Improvements: Tenants may construct buildings or infrastructure, but these revert to the landlord at the lease’s end unless otherwise agreed upon.

- Escalation Clauses: Many ground leases include clauses allowing periodic rent increases.

- Bifurcation: In some cases, landowners sell the land and lease it back to tenants under a ground lease, providing access to low-cost capital.

Differences Between Ground Leases and Land Leases

Ground leases and land leases, while often used synonymously in commercial real estate, can signify distinct arrangements given lease specifics and local terminologies. Both involve a tenant leasing from a landlord for an extended period (often 50-99 years), exploring the land for usage and building, without purchasing the property.

However, under a ground lease, the tenant can develop the land during the lease. At the end, improvements (such as buildings, infrastructure) shift ownership back to the landlord. Here, ground leases tend to put taxes, insurance, maintenance, and other costs on the tenant.

Conversely, land leases can refer to less defined terms or shorter timeframes, allowing tenants to use the land 'as-is' and may not necessitate property revert at the lease end.

These interpretations can differ, so it's vital to thoroughly review and understand lease terms. Consultation with a real estate professional or legal counsel is encouraged.

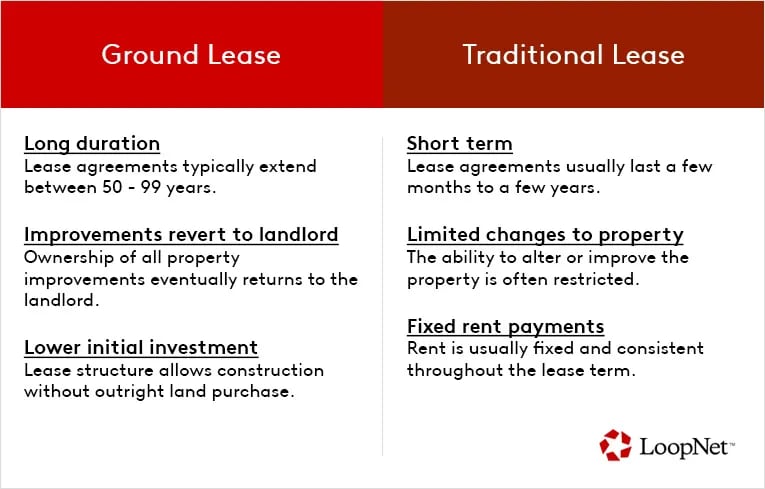

Ground Lease vs. Traditional Lease

The nature and terms of ground leases distinguish them significantly from traditional leases.

In a traditional lease, a tenant rents the property for a much shorter period, usually ranging from a few months to a few years. The tenant doesn't usually make major permanent changes to the property during this period, and the lease agreement typically outlines each party's responsibilities, such as maintenance, insurance, and property taxes. Often, these responsibilities are handled by the landlord unless the lease states otherwise.

In contrast, a ground lease encompasses much more extended periods, generally spanning 50-99 years. During this timeframe, the tenant has the right to construct buildings or make significant improvements to the property, which means the tenant assumes numerous responsibilities traditionally managed by property owners.

While there are plenty of benefits, like being able to develop prime locations, potential tenants must weigh them against the increased responsibilities, long-term commitment, and the eventual surrender of the improvements to the landlord. The decision to enter a ground lease should follow a critical evaluation of these factors.

The key differences between the two are the length of the lease, potential for property improvement, and the distribution of financial and managerial responsibilities, which make each of these lease types suitable for different real estate strategies.

How Does a Ground Lease Work?

In a ground lease, tenants assume responsibility for all property-related expenses, including rent, property taxes, insurance, and maintenance. These leases often include escalation clauses, allowing the landlord to periodically adjust the rent to reflect market conditions or inflation. This lease invites a significant degree of planning, as tenants must negotiate terms aligning with business goals, considering the eventual turnover of improvements to the landlord.

Ground Leases in Practice: Real-World Examples

Ground leases are widely used in commercial real estate, especially by franchises aiming to expand their presence in prime locations. Let’s examine how major global brands like Pizza Hut and McDonald’s leverage ground leases to support their growth strategies.

Pizza Hut: Recognized for its iconic red roofs, Pizza Hut frequently operates under ground leases for many of its store locations. These agreements allow Pizza Hut to secure high-traffic locations without purchasing the land outright. Under a long-term ground lease agreement, Pizza Hut constructs and operates its restaurants while assuming major responsibilities such as paying property taxes, managing insurance, and maintaining the building throughout the lease term. This strategy enables the company to expand its footprint with lower initial capital investment compared to outright property purchases. At the end of the lease, unless a renewal or extension is negotiated, the improvements, including the restaurant building, revert to the landlord, providing long-term value to the property owner.

McDonald’s: Similarly, McDonald’s has long used ground leases to establish its locations worldwide. In many cases, McDonald’s owns the land and leases it to local franchisees who are responsible for constructing and managing the restaurant. This approach benefits both parties: the franchisee gains access to a proven business model in a prime location, while McDonald’s maintains ownership of valuable land assets, ensuring steady income and long-term property value growth. When the lease expires, any improvements, including the restaurant, revert to McDonald’s or the landowner, depending on the lease arrangement.

Pros and Cons of Ground Leases

Pros of a Ground Lease for Tenants

- Access to prime locations

- Lower initial investment

- Increased flexibility

Cons of a Ground Lease for Tenants

- Long term commitment

- Loss of improvements

- Restricted property control

Pros of a Ground Lease for Landlords

- Retaining ownership

- Steady income

- No management hassle

Cons of a Ground Lease for Landlords

- Risk of tenant default

- Missed opportunities if the property value spikes

- Dependence on tenant success

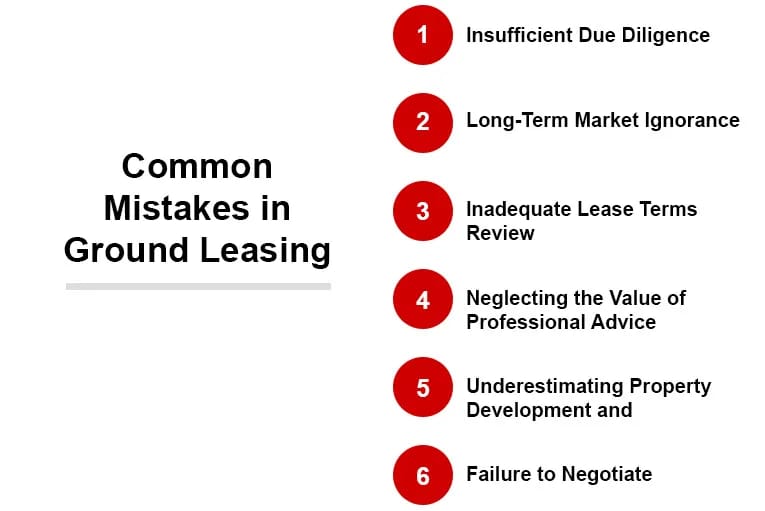

Common Mistakes in Ground Leasing

Like all ventures, ground leasing has its pitfalls. Here are some common mistakes tenants and landlords alike should avoid in ground leasing:

Insufficient Due Diligence

Before entering a ground lease, sufficient research is vital. From verifying the landlord's ownership of the land to evaluating accessibility and zoning restrictions, due diligence can prevent future hiccups. Always consult with legal experts and conduct comprehensive research before signing a ground lease.

Long-Term Market Ignorance

Ground leases last several decades, and market conditions will almost certainly change during this time. Failure to account for long-term market predictions may lead to poor investment decisions. It's crucial to have a thorough understanding of the market dynamics and future predictions applicable to the leased land's location.

Inadequate Lease Terms Review

Every single term or provision in a ground lease agreement can have significant impacts. Small clauses regarding the lease's duration, extension, rent increases, responsibilities upon lease expiration, and handed-over improvements can all endanger the tenant's assets if not carefully reviewed and understood. Always ensure every provision in the agreement is clarified and understood before signing.

Neglecting the Value of Professional Advice

Ground leases are complex. Engaging professionals such as real estate lawyers, brokers, and experienced investors can provide invaluable insights and help detect hidden traps in lease agreements.

Underestimating Property Development and Management Costs

Tenants usually bear the responsibility of developing the property and maintaining it throughout the lease term. Underestimating these costs can severely affect the financial viability of the agreement.

Failure to Negotiate

Landlords often propose the initial lease agreement, but this is usually a starting point and open to negotiation. Tenants who fail to negotiate may find themselves disadvantaged by unfavorable terms. Always consult with real estate professionals when entering a ground lease and stay informed about industry trends and changes. Knowledge and careful planning are your best allies against common pitfalls in ground leasing.

Lease Assignment in Ground Leases

A critical, often overlooked, facet of ground leasing is lease assignment, allowing tenants to transfer lease obligations to another party. Given the high stakes and long-term nature of ground leases, this process can be complex.

At its core, lease assignment establishes a direct relationship between the landlord and the new tenant. The initial tenant may retain some responsibilities if the new tenant defaults on the lease. For tenants seeking greater flexibility, assigning the lease can enable an exit strategy during financial upheavals or new opportunities. However, landlord's consent is usually necessary, contingent upon the new tenant's financial credibility.

Take for example commercial entities like franchises. They often engage in lease assignments, acquiring land for outlets and assigning the ground lease to another entity to build and operate the store.

However, lease assignment involves legal and financial considerations. Tenants should seek advice before proceeding. For landlords, oversight in the assignment process helps ensure property use aligns with their long-term expectations and plans.

What Happens When a Ground Lease or Land Lease Expires?

Upon expiration, the tenant's leasehold improvements-such as buildings or infrastructure-revert to the landlord unless a renewal or extension of the lease is negotiated. Investors must acknowledge this eventuality and plan developments accordingly.

Ground Lease Financing - How to Finance a Building on Leased Land

When considering a ground lease, savvy investors evaluate a range of vital financial elements. They must especially understand cap rate. This critical indicator helps them discern potential returns on their commercial real estate investments.

Understanding financing options, specifically commercial real estate loans, is a vital aspect of engaging in a ground lease transaction. Ground lease financing, a nuanced component of these loan categories, allows development on leased land. The arrangements can be either subordinated or unsubordinated ground leases. In a subordinated ground lease, landlords agree to be secondary if the tenant's lender needs to step in due to a default, which can lead to higher rents for them.

On the other hand, an unsubordinated lease offers more protection to the landlord but may result in lower rental returns. Awareness of how commercial real estate loans function within ground lease financing can be the deciding factor in realizing the full potential of your investment.

Ownership of a Building on Leased Land

Developing on leased land involves detailed agreements outlining ownership rights. Upon lease expiry, customary provisions stipulate the property-including buildings-reverts to the landlord. Tenants and landlords must fully understand and agree to these terms.

What is Bifurcation in Ground Leases?

Bifurcation is a process where a landowner sells the land to a third party and simultaneously enters into a ground lease with the buyer. This strategy provides the original owner with immediate capital while retaining control over the land through the lease. For tenants, bifurcation can reduce upfront costs while ensuring long-term access to the property.

Insights for Real Estate Investors and Developers

Discerning the intricacies of ground leases is key to astute commercial real estate strategies. With careful evaluation and market foresight, investors can leverage ground leases for minimized capital outlays and potential asset increases, while landlords enjoy steady revenue and future property improvements.

To stay current with market trends and make informed investment decisions, consider various property types involved in ground leases, like prime retail locations, office buildings, hotels, industrial properties, and warehouses. Ready to explore these prospects? Browse the various listings available on our website and turn knowledge into investment success.

Commercial Real Estate For Sale