What is a 1031 Exchange? Understanding Tax-Deferred Real Estate Transactions

Key Takeaways

- A 1031 exchange lets investors defer capital gains taxes by reinvesting in like-kind U.S. real estate.

- Both properties must be held for business or investment use, personal residences don't qualify.

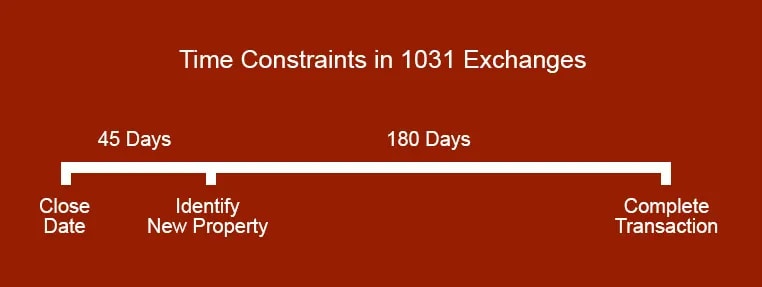

- Strict deadlines apply: 45 days to identify replacement property and 180 days to close.

- Cash received or reduced debt (boot) is taxable, even if most of the transaction qualifies for deferral.

- Includes expert guidance to help investors avoid costly mistakes.

What is a 1031 Exchange?

A 1031 exchange is a tax strategy used by real estate investors to defer paying capital gains taxes on the sale of an investment property. It involves selling one investment property and using the proceeds to purchase another "like-kind" property.

If you're an investor looking to grow your portfolio through 1031 exchange properties, Section 1031 of the U.S. Internal Revenue Code outlines the rules that make this possible. By meeting those requirements, investors can keep capital working instead of losing it to taxes.

The sale of an investment property usually comes with a sizeable tax bill for the seller. The transaction often involves capital gains taxes, depreciation recapture taxes, passive investment taxes and, in most cases, state income taxes, and can sometimes add up to 30% of proceeds. But thanks to 1031 Exchange sellers of commercial real estate can defer these taxes if they instead opt to reinvest the sale proceeds and taxes into a similar property.

Expert insight: Tony Lam, CCIM, Executive Manager at Pinnacle Real Estate Group, real estate lecturer and author of 1031 Exchanges Manual for Real Estate Agents and Investors explains:

"Understanding 1031 exchange fundamentals is crucial because once the relinquished property is sold, conveyed or otherwise transferred, the time window to defer the capital gains taxes and the depreciation recapture tax liabilities close quickly. The exchange rules could be complicated and the use of a QI (Qualified Intermediary)/Exchange Accommodator is required."

Lam adds that failing to follow exchange rules including the use of a QI, coming into physical or constructive possession of the sales proceeds, or not meeting 1031 exchange deadlines can all re-characterize your sale as taxable and eliminate your deferral benefits.

"A first-time exchange investor who doesn't understand the rules or timelines could risk losing the opportunity and the ability to reinvest all of the sale proceeds tax-deferred, having the capital gains and the depreciation recapture taxes recognized would significantly reduce the investor's purchasing power and limit the investors' choices for the replacement property."

The 1031 Exchange involves some technical rules and timelines, but is a relatively straightforward process.

First, the real property being sold must be either held for investment or for use in the taxpayer's trade or business. Second, it must be exchanged for other 'like-kind' property.

What Counts as "Like-Kind" Property in a 1031 Exchange?

Like-kind property includes any U.S. real estate held for investment or business use, regardless of type or quality.

The term "like-kind" has a broad definition in the context of a 1031 exchange, concerning the nature or character of the property rather than its grade or quality. Real estate located in the U.S. is like-kind to all other real estate in the U.S., which allows for flexibility in exchanges: a commercial building for a condo, a farm for a shopping center, etc. It's crucial that both the relinquished and the replacement properties are held for investment or used for business purposes to qualify.

What Properties Qualify, and Don't Qualify, for a 1031 Exchange?

Only U.S. real estate held for investment or business use qualifies, while personal property, residences, and assets like stocks or bonds do not.

To qualify for a 1031 exchange, a property must meet specific criteria:

- Investment or Business Use: The property must be used for investment or in a trade or business. Personal residences, second homes, or vacation homes typically don't qualify unless they have been converted to investment use.

- Like-Kind: The replacement property must be of 'like-kind,' which broadly includes any type of real estate held for the proper purpose but does not cover personal property, stocks, bonds, or financial instruments.

- Domestic Property: The property must be located within the United States to qualify for a tax-deferred exchange under Section 1031. International property exchanges are not covered under this section of the tax code.

What Is the Same Taxpayer Rule in a 1031 Exchange?

The same taxpayer who sells the relinquished property must also acquire the replacement property.

This IRS rule prevents investors from shifting ownership to another entity or individual during the exchange. For example, if an LLC sells an office building, that same LLC must be the buyer of the replacement property to preserve the tax deferral.

Investors should confirm title alignment early in the process. This detail trips up many first-time investors, and a mismatch in ownership names can disqualify the entire exchange and trigger immediate taxes. Advanced investors often coordinate with tax advisors to structure ownership consistently across portfolios, especially when trusts, partnerships, or multiple entities are involved.

What Are the 45-Day and 180-Day Rules in a 1031 Exchange?

Investors have 45 days to identify replacement property and 180 days to close the purchase.

Missing either deadline can disqualify the exchange and trigger taxes, which is why expert planning and clear guidance are essential.

New and experienced investors alike can make mistakes when it comes to these specific deadlines, Lam adds.

"Many new exchange investors are uncertain as to when exactly the 45-day replacement property identification period or the 180-day closing period begin. Even seasoned investors might not be aware that the 180-day rule might not actually provide the investor 180 days to close the replacement property."

Lam goes on to explain that there can be other considerations that affect the standard 1031 deadlines and that are important for investors to be aware of.

"In addition to the 45 calendar day replacement property identification deadline, an exchange investor must also receive all of the replacement properties and have the properties exchange transactions completed and legal titles transferred no later than (A) 180 calendar days after the date the relinquished property has been transferred, or, (B) the income tax return due date (including any extensions of time to file) for the tax year in which the relinquished property was sold, whichever is earlier."

He adds that, as an exchange investor, you must finish the exchange, including taking the legal title to every like-kind replacement property on your identification list by the earlier of:

- (1) 11:59pm on the 180th calendar day following the transfer of the first relinquished property, or

- (2) the due date of the exchangor's federal income tax return for the tax year in which the relinquished property was transferred, including any extensions of time to file.

"Many investors underestimate how fast the 45-day replacement property identification period passes and scramble to identify suitable replacement properties under pressure. To avoid this, the investors should work with an experienced tax-deferred exchange broker and a reputable Qualified Intermediary/Exchange Accommodator well in advance of closing of the relinquished property to evaluate options and line up viable replacement properties early," Lam says.

A key, however, is that the selling taxpayer cannot come into physical or constructive possession of the sale proceeds during the exchange period. Unlike traditional commercial real estate loans, where funds flow directly to the borrower, in a 1031 exchange the seller must designate a qualified intermediary to hold the funds under an exchange trust agreement. This can be done quickly, often within a day or two before closing, if necessary.

Why Do You Need a Qualified Intermediary in a 1031 Exchange?

A qualified intermediary ensures investors never take possession of the funds, preserving tax deferral.

A qualified intermediary, or exchange facilitator, is required in every 1031 exchange. They hold the sale proceeds so the investor never takes constructive receipt of the funds, which is critical to preserving tax deferral. The intermediary also documents the transaction and ensures IRS rules are followed.

During the exchange period, the seller cannot access the funds directly but can instruct the intermediary to apply them toward any replacement property identified within the 45-day window. For new investors, this safeguard may feel restrictive, but it protects you from losing the tax benefit.

Tony Lam cautions that investors often underestimate the risks of poor QI selection. It's crucial to use extreme care and stringent due diligence when you're selecting a QI, since if they fail to meet their obligations your exchange can be at risk, he adds.

"Even without fraudulent conduct or criminal misuse absconding the exchange funds, a Qualified Intermediary could nonetheless become insolvent because of its own financial circumstances and unable to meet its exchange obligations at all or in a timely manner. The QI's failure to fulfill its exchange responsibilities could result in the exchangor's failure to complete the exchange or not being able to meet the non-extendable exchange deadlines; thereby invalidating the exchange from the non-recognition of gain 1031 exchange tax-deferred treatment."

He also notes that a QI often operate with very few requirements. QIs are:

- NOT required to be professionally licensed.

- NOT required to be certified.

- NOT required to be regulated.

- NOT required to be bonded.

- NOT required to be audited.

- NOT required to maintain any minimum equity capitalization.

- NOT required to maintain any reserve funds.

- NOT required to be monitored, no regulatory oversight by any regulatory bodies or any federal or State government agencies.

- NOT required to limit the number of exchangors or cap the amount of exchangors' sale proceeds that can be deposited with the QI at one time, the total exchange funds held by a large Qualified Intermediary could exceed tens and hundreds of millions of dollars.

- QI trust funds are NOT FDIC insured in client's name and FDIC protection limit is only $250,000 per account. One single client's exchange funds could well exceed multiple times the $250,000 maximum FDIC protection limit.

For this reason, investors should thoroughly vet intermediaries and, whenever possible, work with bonded and insured firms. To defer all taxes, the full sale proceeds must go into the replacement property. This includes cash received at closing minus any mortgage debt paid off.

What Is "Boot" in a 1031 Exchange?

Boot is any cash or debt reduction in a 1031 exchange that becomes immediately taxable.

In a 1031 exchange, any cash received or reduction in debt that isn't rolled into the replacement property is called "boot." Boot is taxable, even if most of the transaction qualifies for deferral.

Investors often underestimate the debt replacement rule, Lam says.

"I've seen investors who have cashed out significant amount of the relinquished property's equity and were unable to qualify for the loans required on the replacement properties to meet the debt replacement exchange rule... Even if the investor reinvests all the cash/equity but fails to replace or replaces only a portion of the total debts of the relinquished property, the non-debt replacement or the reduction of debt replacement would be classified by the Internal Revenue Service as 'boot' and such a mortgage boot will be taxed."

For example, Lam adds, say an investor has a $500,000 loan remaining on the relinquished property at teh time of dispostion, but secures only $300,000 in a new loan on the replacement property. That $200,000 loan reduction would be be classified as a "mortgage boot" and treated as taxable income, he says.

For this reason, investors should evaluate financing and debt replacement requirements early, and ensure replacement property loans are structured to cover both equity and debt obligations. Once the relinquished property is sold, failing to qualify for sufficient financing can result in unexpected taxable boot.

How Does Depreciation Recapture Work in a 1031 Exchange?

Depreciation recapture taxes can be deferred through a 1031 exchange, but become taxable if the property is sold without reinvestment.

Depreciation recapture is an important tax element to consider during a 1031 exchange. It refers to the tax levied on the depreciation deductions claimed on a property, taxed as ordinary income upon sale. Through a 1031 exchange, depreciation recapture, along with capital gains taxes, can be deferred. This allows the investor to use the full amount of the property's equity for reinvestment in like-kind real estate. However, if a property is sold without reinvestment in a like-kind exchange, the depreciation taken over the years is subject to be recaptured by the IRS, which can significantly impact both the investor's tax liability and overall commercial property value. Understanding this concept is crucial for realizing the full benefits of a 1031 exchange in real estate investment strategies.

How Do 1031 Exchanges Help with Estate Planning?

They allow investors to pass property to heirs with a stepped-up basis, erasing deferred tax liabilities.

One of the most powerful advantages of a 1031 exchange is how it ties into estate planning. When an investor passes away, heirs inherit the property at its stepped-up market value, effectively erasing the deferred tax liability. This means decades of rolled-over gains can be passed on without triggering capital gains taxes, Lam adds.

"When a property owner passes away, the tax basis of their real estate is stepped up to the fair market value as of the date of death. This eliminates all capital gains accumulated during the owner's lifetime, with only future appreciation taxable to heirs or a surviving spouse. If the properties were held in a living trust or a disregarded entity such as a single-member LLC, the replacement properties received via a 1031 exchange also benefit from this step-up in basis.

For retirees and long-term investors, this strategy offers both security and legacy. By combining 1031 exchanges with a stepped-up basis, families can preserve more wealth across generations while keeping portfolios intact. Advanced investors often use this approach to build stable, income-producing assets that transition smoothly to heirs.

There are some differences for entities taxed as partnerships, such as multi-member LLCs that osn property, Lam adds.

In contrast, for non-disregarded entities like multi-member LLCs or partnerships, heirs only receive a step-up on the decedent’s ownership interest—not the underlying property itself. In community property states such as California, all community property receives a 100% step-up in basis when either spouse dies, regardless of which spouse passes first."

By combining these rules with multiple successive 1031 exchanges, seasoned investors can defer taxes over decades. At death, the step-up effectively wipes out deferred liabilities, allowing heirs to inherit property portfolios with a clean slate and stronger long-term wealth preservation.

What is an Example of a 1031 Exchange?

Consider an investor who owns a small retail strip center valued at $3 million with a $1 million mortgage. After several years of steady income, they decide to trade up into a larger $5 million industrial warehouse to capture higher rental demand. By using a 1031 exchange, the investor can apply the full $3 million in equity plus new financing toward the warehouse without paying taxes on the gain from the retail property.

This move defers capital gains and depreciation recapture while shifting the portfolio into a property with stronger long term income potential. For many commercial investors, 1031 exchanges are a way to reallocate capital into higher-performing assets without losing momentum to taxes.

What Should Investors Take Away from 1031 Exchanges?

Now that you understand the basics of 1031 exchanges and their potential benefits for real estate investors, you're better equipped to make informed decisions about your investment strategy. These tax-deferred transactions can be a powerful tool for portfolio growth and tax management. To explore potential replacement properties and investment opportunities, browse available commercial real estate for sale.

Commercial Real Estate For Sale

Frequently Asked Questions

How do I report a 1031 exchange to the IRS?

You report a 1031 exchange by filing IRS Form 8824 with your tax return for the year the exchange occurred. The form requires details such as property descriptions, dates, values, and any liabilities assumed or relieved. Completing it correctly is critical to maintaining the tax deferral.

How many 1031 exchanges can I do?

There is no limit to how many times you can use a 1031 exchange. Investors often roll gains forward through multiple properties over their lifetime, deferring taxes until they eventually sell without reinvesting. In some cases, the tax liability can be eliminated altogether if heirs inherit the property with a stepped-up basis.

Do 1031 exchanges still apply to personal property?

No, 1031 exchanges no longer apply to personal property after the Tax Cuts and Jobs Act of 2017. Items like aircraft, equipment, and franchise licenses used to qualify, but today only real property, as defined by the IRS, is eligible for 1031 treatment.

Can I change ownership of a replacement property after a 1031 exchange?

It's best to hold the replacement property under the same ownership for several years before making changes. If you transfer ownership too quickly, the IRS may view it as a step transaction and disqualify the exchange. Planning ahead with a tax advisor helps avoid costly mistakes.

About Tony Lam

Tony Lam is a nationally recognized real estate lecturer, trainer, and author with decades of experience guiding professionals and investors through complex transactions. He is the author of "1031 Exchanges Manual for Real Estate Agents and Investors", a highly regarded resource on the strategies, rules, and financial analysis behind tax-deferred exchanges.

A Certified Commercial Investment Member (CCIM) and California Department of Real Estate Subject Matter Expert Consultant, Tony has authored state approved CE courses and trained countless licensees in investment analysis and compliance. He serves as a Certified Instructor, Professional Standards Administrator, and board member within leading real estate associations, contributing his expertise to elevate industry standards.