Understanding the Triple Net Lease

If you're a tenant looking to lease commercial real estate, or an investor interested in NNN properties for sale, you may notice landlords offering space on a triple net basis. Triple net (or NNN) leases provide tenants with enhanced transparency and control over expenditures. This type of agreement is one of several "service types" commonly found in commercial real estate leases.

What Is a Triple Net Lease? What Does NNN Mean?

The term "triple net lease", or NNN lease, is a type of commercial real estate lease agreement where the tenant pays a base rent to the landlord, as well as their own operating expenses directly to the service and utility providers. The "N" in NNN stands for “net of” or exclusion of certain expenses. These usually include utilities, property taxes, building insurance, and maintenance or repairs in common areas of the building - which is essentially the meaning of a triple net lease.

True triple net leases are often executed by tenants who occupy an entire building, although they can also be established in multi-tenant buildings. In a multi-tenant setting, landlords who offer triple net leases typically let tenants pay for in-suite utilities directly, and charge tenants a fixed amount to cover shared costs in relation to taxes, insurance, maintenance, etc.

Six Key Elements of a Triple Net Lease

1. Base rent: This is a basic rent figure that excludes additional costs related to working in a building, such as utilities, building maintenance, building taxes, etc. Base rent is typically quoted on an annual per-square-foot basis, so a tenant occupying 2,000 square feet at a base rent of $10 per square foot would pay $20,000 annually in base rent.

2. Utilities: This category can include electric, gas, water, sewer, etc. Typically, if a landlord offers a triple net lease arrangement, it is because individual metering is available at the building, enabling the tenant to pay utility providers directly. If master-metering is the only option, the landlord will devise a way to apportion costs, as best they can, based on each tenant’s usage, and these formulas or methodologies should be detailed in the triple net lease.

3. Cleaning expenses: As one might expect, these include costs related to janitorial services, trash collection, recycling, vacuuming, etc. in both common areas and tenant spaces. Tenants pay for the full cost of cleaning their direct space and a pro-rata share of the costs incurred to clean common areas.

4. Real estate taxes: Taxes are based on the assessed value of the building, usually determined by a commercial real estate appraisal, and are paid roughly once a year. The tenant pays a pro-rata share of the building's property tax, meaning each tenant pays a portion of the total tax bill based on the percentage of building space they lease. So, if a tenant occupies 20,000 square feet in a 100,000 square foot building, they will pay 20% of the tax bill. Tenants should be prepared for these expenses to fluctuate based on assessments.

5. Property insurance: This is insurance held by the landlord to offset claims against building damage, accidents, etc. Like real estate taxes, each tenant pays a pro-rata share of the total premiums based on the percentage of the building leased by that tenant. Tenants pay their portion of premiums to the landlord who pays the insurance provider directly.

6. Common area maintenance costs: Often referred to as CAM charges, these are expenses incurred to operate and maintain the common areas of a building, including lobbies, exercise rooms, restrooms, shared conference rooms, elevator lobbies, landscaping, and parking lots. Expenses incurred typically relate to utilities, cleaning, maintenance, and property management. Each tenant pays a pro-rata share of the total costs based on the percentage of the building leased by the tenant.

Triple Net Lease Pros and Cons

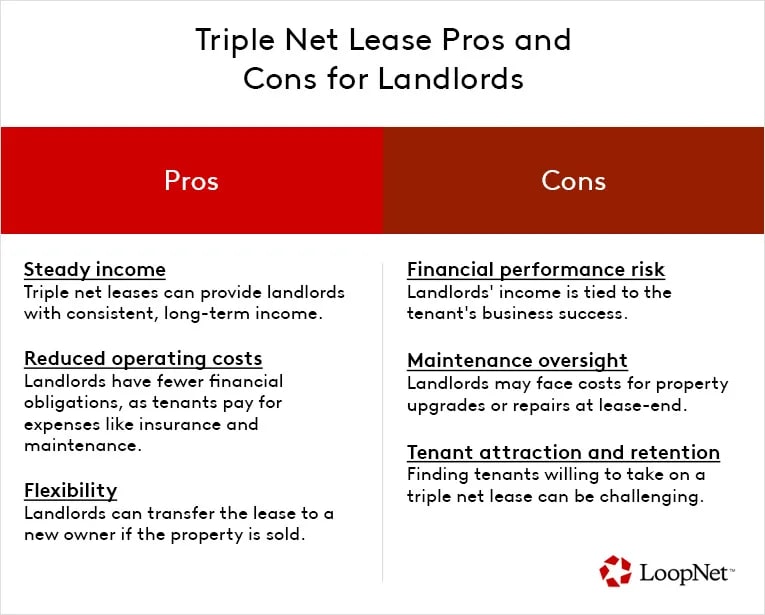

In evaluating commercial lease arrangements, considering the pros and cons from both landlords' and tenants' perspectives is critical. A triple net lease isn't a one-size-fits-all solution; its advantages or disadvantages will depend on the specific circumstances of the potential landlords and tenants.

Triple Net Lease Advantages for Landlords

1. Steady Income: With the lease term typically ranging from 10 to 25 years, triple net leases can provide landlords with consistent, reliable income over a long period.

2. Minimal Operating Costs: Considerably reducing a landlord's financial obligations, as the tenant is responsible for expenses such as insurance, maintenance, and property taxes.

3. Transference: Landlords have the flexibility to transfer the lease to a new owner if the property is sold.

Risks and Considerations for Landlords with a Triple Net Lease

Investing in a triple net lease property can offer landlords steady, long-term income with reduced day-to-day financial obligations. However, despite these advantages, landlords should be aware of the potential downsides and risks:

1. Financial Performances: The stability of revenue from triple net leases depends heavily on the tenant's business success. Should a tenant's business falter, their ability to meet lease obligations could be compromised, affecting the landlord's expected income.

2. Maintenance Oversight: While tenants are responsible for maintenance, any neglect could result in significant expenses at lease-end. Landlords may face the need to invest in property upgrades or repairs to attract new tenants, adding to rollover costs.

3. Tenant Attraction and Retention: Finding tenants ready to take on a triple net lease’s obligation might be challenging, potentially leading to prolonged vacancies. These can be especially impactful due to the typically lengthy commitments of triple net leases, ranging from 10 to 25 years.

4. Revenue Fluctuations: This lease structure usually results in lower rents as tenants cover most of the property expenses, potentially limiting the landlord's revenue compared to traditional leases.

Given these considerations, landlords are encouraged to undertake thorough due diligence. Evaluating prospective tenants' financial health, assessing the property's current condition, and staying abreast of market trends are essential steps to mitigate investment risks and ensure a beneficial triple net lease arrangement.

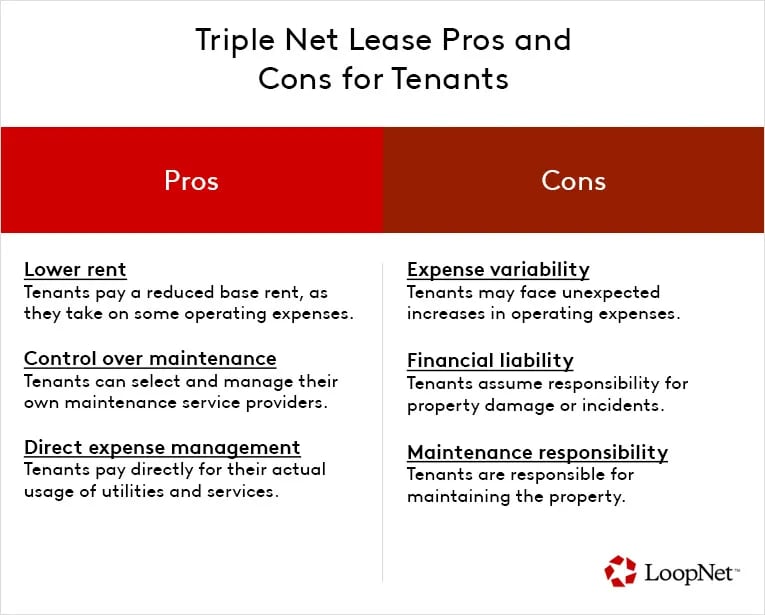

Benefits for Tenants with a Triple Net Lease

Shifting the responsibility of property expenses to the tenant, can facilitate several financial benefits:

1. Lower Rent: One of the most appealing aspects of a triple net lease is the reduced base rent. Tenants, taking on the additional expenses, benefit from paying less in rent compared to gross leases. Moreover, landlords may also offer a tenant improvement allowance, which can be used to customize or renovate the leased space to fit the tenant's needs.

2. Control Over Maintenance: Tenants have the freedom to select and manage their maintenance service providers. This control can lead to cost savings and ensures that the quality of services aligns with their needs.

3. Direct Expense Management: Tenants pay directly for their actual usage of utilities and services, promoting fairness and transparency. This ensures that businesses are not paying more than necessary and helps in precise budget forecasting.

4. Proactive Budgeting: Knowledge of previous years' operating expenses enables tenants to anticipate future costs and budget accordingly. Such insight is vital for long-term financial planning and avoiding unexpected expenses.

5. Tax Deductions: A key financial aspect of triple net leases is the ability for tenants to potentially deduct property expenses, such as property taxes, maintenance, and insurance, as business expenses on their tax returns. It is advisable for tenants to seek guidance from tax professionals or certified public accountants to maximize eligible deductions and ensure compliance with tax laws.

Challenges for Tenants with a Triple Net Lease

While a triple net lease can offer certain benefits, tenants must consider its potential drawbacks:

1. Expense Variability: Due to the fluctuating nature of direct expenses, like utilities and maintenance, budgeting can be challenging. Tenants are responsible for these costs, which may escalate unexpectedly due to market changes or increased usage.

2. Financial Liability: Tenants assume the risk for any property damage or incidents that result in additional costs. This financial responsibility extends to shared expenses such as property taxes and insurance premiums, which can rise due to factors beyond the tenant’s control, like reassessments or claims.

3. Maintenance Responsibilities: Tenants oversee maintaining the property, which can encompass significant outlays for repairs or upgrades to an asset they do not own. This obligation can lead to substantial expenses, particularly if the property is not adequately maintained.

Carefully evaluating these risks is crucial for tenants considering a triple net lease. It's important to thoroughly analyze one's ability to manage these potential costs against the backdrop of business stability and financial planning. Both landlords and tenants need to diligently assess the terms and align them with their strategic objectives to determine if a triple net lease is the most suitable agreement for their situation.

The Critical Difference Between NNN and Gross Leases

In a full-service gross lease, while the tenant pays a fixed monthly rent, the landlord takes the responsibility for all operating expenses such as utilities, taxes, insurance, and maintenance. Some properties offer a modified gross lease that balances expense sharing between parties, while others use a Triple Net lease where tenants are responsible for these costs.

However, the quoted rents for a full-service lease might appear more at face value compared to a Triple Net lease. For instance, an office space with an asking price of $20.00 per-square-foot per month under a Triple Net lease may seem more affordable initially. However, once you add the extra charges for operating expenses, janitorial services, and electricity which could add up to an additional $15.00 per-square-foot per month, you could end up paying $35.00 per-square-foot per month in total - mirroring the cost of a full-service gross lease.

Remember, when negotiating a lease, it's crucial to ask for detailed information on what costs the lease includes. Not every deal that seems too good to be true is as it appears! Make sure to consider all these factors for a clearer picture of the total cost you'll be bearing to lease and occupy your chosen commercial space.

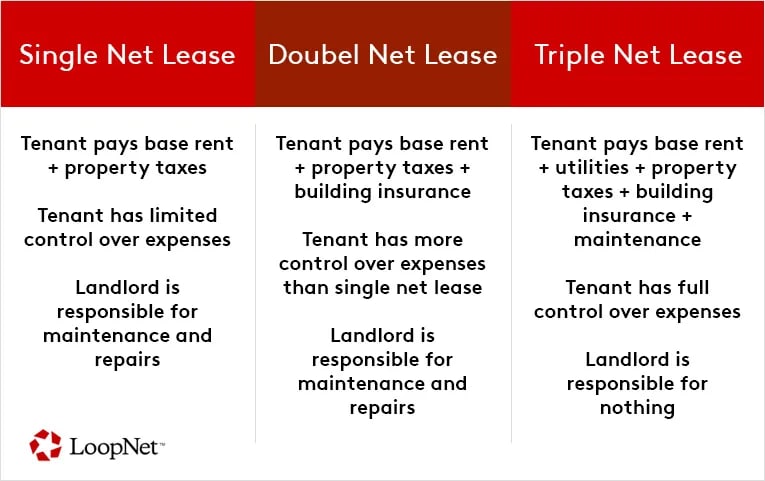

Comparing Triple Net Lease with Single and Double Net Leases

Choosing the right lease for a commercial property can be a complex decision, as it largely depends on the unique circumstances and needs of both the tenant and the landlord.

Single Net Lease: This is the most basic type of commercial lease. Under a single net lease (also known as an "N" lease), the tenant pays the base rent plus the property's real estate taxes. All other expenses such as maintenance, utilities, and insurance remain the responsibility of the landlord. While it provides the tenant some flexibility on operating costs, a single net lease does not allow as much control over property expenses compared to a triple net lease. Therefore, a tenant might opt for this lease type if they prefer lower risk and responsibility.

Double Net Lease: One step closer to a triple net lease is the Double Net Lease (or NN lease). In this case, the tenant agrees to pay the base rent, real estate taxes, and building insurance. It is a middle-ground lease arrangement, where the tenants shoulder more responsibility than in a single net lease but less than in a triple net lease. Maintenance and repairs costs, however, remain the domain of the landlord. This type of lease may be a good fit for tenants who want to have more control over their expenses but do not want the full array of responsibilities that come with a triple net lease.

The single and double net leases provide less control to tenants over property expenses compared to triple net leases. However, they also carry fewer responsibilities and potential financial risks. Therefore, when selecting the right lease type, both landlords and tenants must weigh the cost transparency, control benefits, and added responsibilities of a triple net lease against its counterparts. The ideal choice will depend on each party's specific circumstance and risk tolerance.

Understanding the Nuances of Triple Net Leases

Triple net leases are tailored to match the distinct needs and circumstances of each property, landlord, and tenant, without a one-size-fits-all approach. Key variations include:

Single-Tenant Properties: Tenants are responsible for all costs, from everyday operations to significant capital expenses, suitable for those considering long-term investments and stable leasing costs.

Multi-Tenant Properties: Tenants share common area expenses while often using commercial real estate loans to manage their internal space enhancements, balancing operational impact with financial fluidity.

Lease Sub-Types: While standard NNN leases are common, absolute net leases that shift all expenses to the tenant exist but are rarer due to their demanding nature.

Investors need to scrutinize these leasing structures thoroughly to ensure alignment with their investment strategies and long-term business objectives.

How Single-Tenant Triple Net Leases Differ from Other NNN Investments

For investors looking at triple net lease properties, a key distinction exists between multi-tenant and single tenant triple net leases (STNLs). In an STNL, one tenant occupies the entire property and assumes full responsibility for operating expenses, making it an attractive investment for those seeking stable, passive income. STNL properties typically feature creditworthy tenants with long-term leases, reducing vacancy risk and providing predictable returns.

Closing Thoughts:

Understanding different commercial lease types is crucial for making informed decisions about your business space. Triple net leases offer unique advantages and considerations for both tenants and landlords. To explore available properties and find the right fit for your business needs, browse available commercial real estate for lease.

Commercial Real Estate For Lease