Tulsa, Oklahoma, Offers Promising Opportunity for Industrial, Tech Real Estate

Tulsa, Oklahoma, was merely a runner up in a nationwide real estate search led by billionaire Elon Musk for a new Tesla automotive plant, but that process may let it win more attention from property investors.

Three reasons why Tulsa stands out involve industrial real estate, a property type that has surged in demand as more consumers shop online and create a need for added logistics centers and warehouses. While Tesla ultimately decided to build a plant in Austin, Texas, it was lured by forces that led industrial real estate in Tulsa, even with 1 million fewer people in the surrounding region than Austin, to grow to 108 million square feet of space to surpass Austin's 107 million square feet, according to CoStar data.

That industrial real estate is less than half the price in Tulsa than it is in Austin, and Tulsa is outpacing its Texas rival for new construction of that property type. Real estate professionals say the presence of far more industrial real estate per capita, and at a far lower cost, in Tulsa than in high-profile Austin shows Oklahoma's second-largest city is primed for manufacturing growth. It also helps explain why Tulsa came down to the wire after Tesla initially looked at eight centrally located U.S. states to house its $1 billion, 4 million- to 5 million-square-foot manufacturing plant, a site that's expected eventually to create 5,000 jobs to make the Model Y and Cybertruck.

Tesla’s interest in Tulsa confirms the city's desirability for large-scale advanced manufacturing projects and, even though historically dominated by the oil and gas industry, an ability to diversify its industries, said Chris Schwinden, a senior vice president who leads the industrial business for the Dallas-based Site Selection Group advisory firm.

“If you look at its location in the south central United States, it makes a lot of sense that big companies want to be there,” said Schwinden, who's familiar with the region but isn't involved in Tulsa deals. “Tulsa is a really strong manufacturing market with robust training programs and a strong pipeline of labor. Tulsa is a Goldilocks-type of market that's big enough to satisfy hiring needs and not too big in which a company might have to deal with traffic congestion and other issues that pop up in larger cities.”

The region has strong real estate fundamentals with its vacancy rate hovering at 4%, said Paul Hendershot, CoStar's director of market analytics for North Texas and Oklahoma.

"Tulsa has flown under the radar for quite some time and Tesla's interest has brought the city to the forefront in terms of growth and quality of life," Hendershot said in an interview.

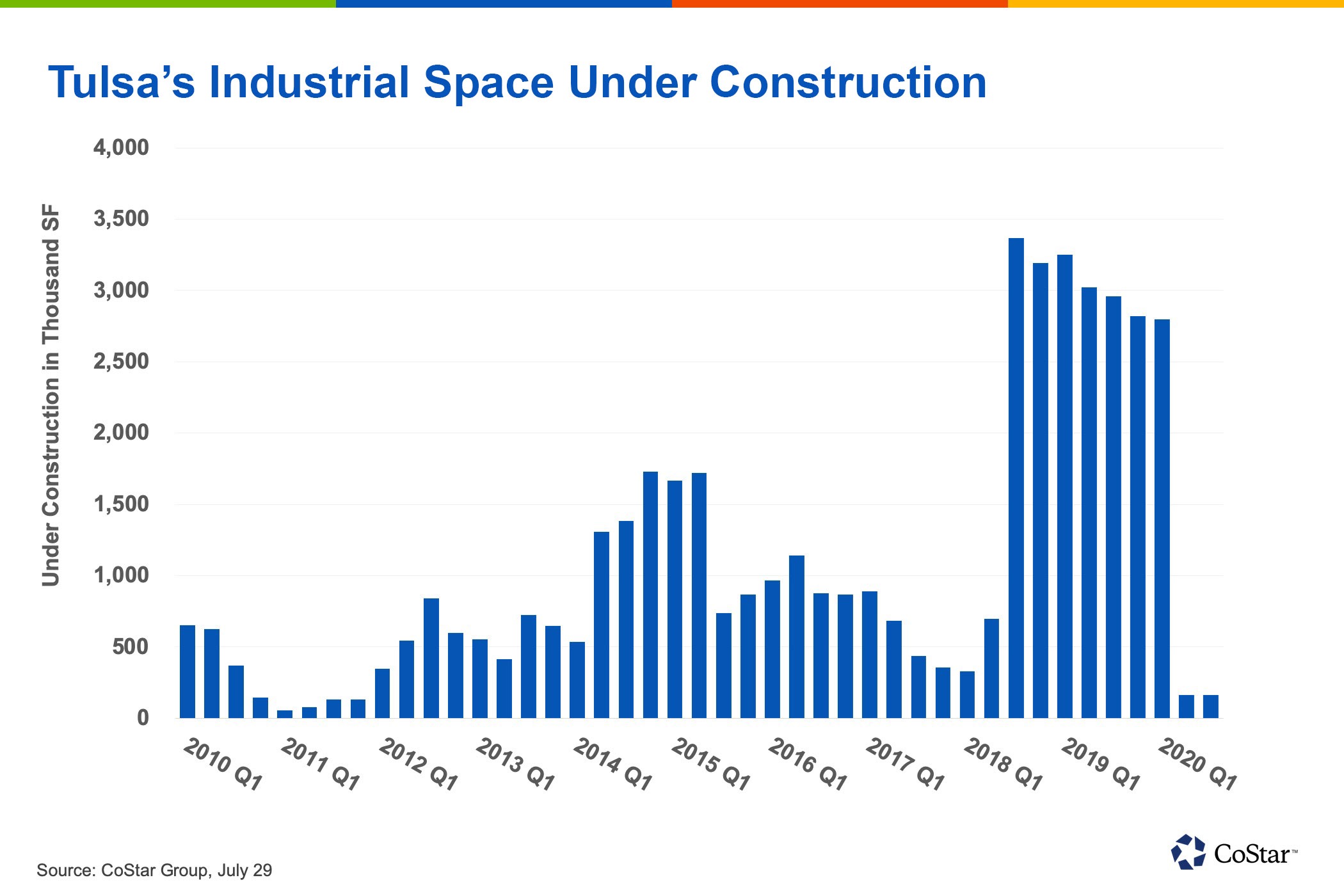

Developers in Tulsa don't tend to build large amounts of speculative industrial buildings as they do across the Red River in Texas. Instead, Oklahoma developers tend to wait to have a tenant in tow before beginning construction, he said.

That patience paid off with Tulsa landing a four-story, 2.56 million-square-foot Amazon e-commerce hub near the Muscogee Creek Nation that Hendershot said was "the crowning jewel of the decade for Tulsa," with a lot of land to do more deals. For real estate investors, Tulsa, which Hendershot says is like Austin a decade ago, can be seen as a bargain compared to the capital city of Texas, which ranked No. 1 in the nation for commercial real estate prospects and demand this year, according to the Urban Land Institute's annual survey.

Lower Prices

Industrial property in Austin sells at an average of $133 per square foot, more than double Tulsa's average price tag of $54, according to CoStar data. Property taxes have been steadily rising in Austin over the years and a key component of Tesla picking the Texas city for its new plant was millions of dollars in property tax abatements approved by local governments. Any potential incentives Tulsa offered Tesla were not disclosed.

Other major industrial developments in Tulsa include a new $550 million maintenance facility totaling 193,000 square feet being developed by American Airlines, which is the Texas-based airline's largest investment in a maintenance facility to date. Tulsa has completed 3.1 million square feet of new industrial facilities in the past 12 months, edging out Austin, which built 2.5 million square feet of new space during the same time, according to CoStar data.

Tulsa is a "really big small town" with growth potential because of what he calls business-friendly atmosphere and economic development help from the surrounding tribes in Oklahoma, said Schwinden.

"The tribal participation in economic development in Tulsa and, more broadly in Oklahoma, can be a big advantage for companies," Schwinden said in an interview. "It's a little bit of the secret sauce as it relates to economic development in Oklahoma being positioned to win big deals."

Native American tribes helped bring some big names to Oklahoma with the Cherokee Nation and the Muscogee Creek Nation being part of a larger coalition in helping e-commerce giant Amazon expand its presence in Tulsa. Years ago, the Cherokee Nation brought a half million dollars of economic incentives to a deal to bring a 1.2 million-square-foot distribution center for Macy's to Tulsa.

For potential employers, Schwinden said Tulsa could be a "surprisingly cool" choice with an arts and museum and culinary scene. City leaders created the Tulsa Remote program in 2018 to lure diverse young professionals with remote jobs by giving them up to $10,000 and office space in coworking locations. The program is funded by the George Kaiser Family Foundation, which recently donated $50 million to develop workforce development programs in Tulsa targeting jobs in energy technology, virtual health, drones, cybertechnology and data analytics.

As part of the $50 million investment, the Holberton School, a coding academy in San Francisco, is expected to open its third U.S. campus in Tulsa in early 2021. Billionaire George Kaiser made his money in oil and gas and banking and he opened The Gathering Place, a 66-acre park in Tulsa that's the largest public park in the country built with private funds, in 2018.

Several high-profile tech companies are planning a permanent work-from-home setup because of the pandemic and Tulsa might be a draw for workers and employers looking to exit big city life and rents, Schwinden said. For investors, this could be a good time to prepare for what is expected to be a bigger future for the city.

"There's an opportunity for Tulsa to better prepare with the help of developers, investors and especially the local community, which can play a big role in these industrial parks," Schwinden added.

Social media giant Facebook plans to hire remote employees in areas such as Dallas, Denver and Atlanta and pay them salaries based on their location, a move that could save Facebook a substantial amount considering the average annual tech salary in its hometown in Silicon Valley is $136,060, the highest in the nation, according to CBRE.

Growth Potential

Tulsa ranked as one of the 25 smaller markets to watch this year for growth potential for fostering tech talent development, according to CBRE's Scoring Tech Talent report. Tulsa had 13,040 tech workers in 2019, up 34% over the past year, with an average salary of $77,701, according to CBRE. Austin, meanwhile, ranked No. 6 on the report out of large markets and had 76,270 tech jobs in 2019, up 16.7% since 2014, paying an average annual salary of $95,416, according to CBRE.

Still, Tulsa has a high concentration of energy companies and is expected to be hurt by low oil prices. Energy companies have been hesitant to add jobs back, and consolidation and closings are disrupting Tulsa's office sector, according to a CoStar market analytics report.

And Austin's commercial real estate growth in the past decade has an edge over Tulsa in terms of two high-profile cultural factors: The Austin music scene is so strong it fostered the television program and festival Austin City Limits, which gave that city a national profile. Austin also is home to the well-known University of Texas at Austin, which provides so much trained technology workers that global companies like Google, Facebook and Apple have opened offices in the city. Those names often result in smaller tech companies popping up in the same area.

Even so, Tesla's Musk said on an earnings call last week when it posted its fourth consecutive quarter of positive profits that the Fortune 500 company will consider Tulsa for future expansions. That "bodes well for the future" of the city, said Bill Murphy, who oversaw economic development for the Tulsa Regional Chamber during the Tesla search. He now holds a deputy secretary role with the Kansas Department of Commerce.

"This reflects the community at large really put forward a positive image of the state and the community and we were able to compete with a world class city like Austin," Murphy said in an interview. "To have Elon Musk mention your city in an earnings call is every economic developer's dream."

As far as proceeding on any immediate large-scale development, the Tulsa area has three sites ready to go. MidAmerica Industrial Park is a business area involved in large industrial deals with tenant companies such as DuPont and Google, officials said.

Other sites being heavily marketed by Tulsa leaders include the Peoria Mohawk Business Park, an industrial area developed by the George Kaiser Family Foundation and the city of Tulsa in a partnership to drive business to north Tulsa, and the Claremore Industrial Park in Claremore, Oklahoma. Other sites near Tulsa, including in Broken Arrow and Muskogee, are also development possibilities.

Justin McLaughlin, executive vice president and chief operating officer for the Tulsa Regional Chamber, said finding large industrial development areas across the country can be difficult, but the Tulsa region has several "shovel ready" sites ready to go.

"You don't get looked at for these large projects unless you have the sites," said McLaughlin, who also is interim senior vice president for economic development, in an interview. "This put us on the radar screen with consultants and now there's a lot of information out there on us."

Murphy agrees, adding "this kind of publicity will pay dividends for another couple of months to a year."