What Is a Cap Rate?

What Is a Capitalization (Cap) Rate?

A cap rate, or capitalization rate, is a critical metric used in commercial real estate to evaluate the potential return on investment for an income-producing property. It is expressed as a percentage and represents the ratio between the property's net operating income (NOI) and its current market value or purchase price.

Jonathan Squires, managing director at Cushman & Wakefield, explains, "A cap rate expresses an anticipated annual return on an investment property." This metric provides a straightforward way for investors to compare the profitability and risk levels of different properties, regardless of their type or location.

What Is a "Good" Cap Rate?

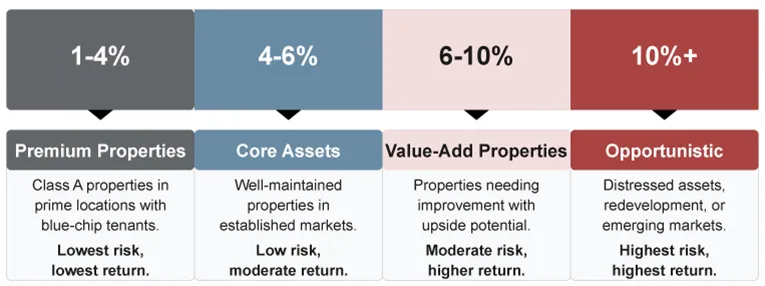

Defining what constitutes a "good" cap rate can significantly vary based on several factors, mainly: the investor's objectives, risk tolerance, the property's location, and the broader market conditions.

A cap rate between 4% and 10% is considered standard in the commercial real estate industry. However, what could be seen as an exceptional cap rate for one investor might not suit another's investment goals.

For an investor seeking a safer, more stable return, a building in a prime location with a cap rate of 4% to 6% might be seen as "good," due to the lower associated risk, despite the potentially lower return on investment. Conversely, an investor with a higher tolerance for risk might consider a cap rate of 8% to 10% (or even higher) to be more attractive.

Typical Cap Rate Ranges by Property Type and Market

| Property Type | Primary Markets | Secondary Markets | Tertiary Markets |

|---|---|---|---|

| Multifamily | 3.5% - 5.0% | 4.5% - 6.0% | 5.5% - 8.0% |

| Office | 4.0% - 6.0% | 5.5% - 7.5% | 7.0% - 9.5% |

| Retail | 4.5% - 6.5% | 6.0% - 8.0% | 7.5% - 10.0% |

| Industrial | 4.0% - 5.5% | 5.0% - 7.0% | 6.0% - 8.5% |

| Hotel | 5.5% - 7.5% | 7.0% - 9.0% | 8.5% - 11.0% |

Disclaimer: Cap rates shown represent typical ranges based on general market trends and may vary significantly depending on specific property attributes, exact location, current market conditions, and other factors. These figures are provided for illustrative purposes only and should not be used as the sole basis for investment decisions. Always consult with a qualified real estate professional and conduct thorough due diligence before investing.

Factors Influencing Cap Rates

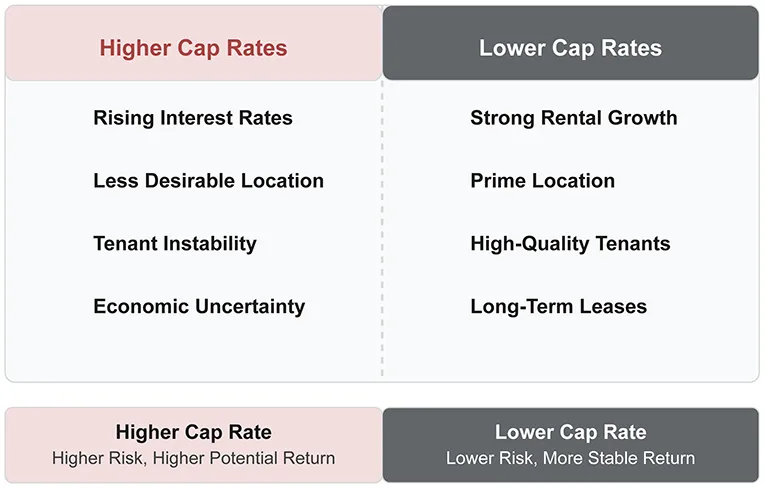

Market Conditions

Cap rates are influenced by various market conditions, including supply and demand, interest rates, and economic growth. For instance, a booming economy can increase demand for real estate, raising property prices and consequently lowering cap rates.

Local Property Market

The local property market significantly affects cap rates. Properties in high-traffic, desirable areas typically have higher values and lower cap rates. Conversely, properties in less attractive areas tend to have lower values and higher cap rates.

Property Investment

The capital invested in a property can directly impact its cap rate. Upgrading a property can lead to higher rents, increasing the NOI and potentially lowering the cap rate. Lenders often consider both cap rates and loan to value ratios when evaluating financing options, as lower cap rates typically correlate with lower LTV requirements in prime markets.

Dynamic Nature of Cap Rates

Cap rates are not static; they reflect the interaction of multiple market elements and investment decisions. Factors like sourcing a suitable CRE loan and leveraging tax deferral strategies, such as a 1031 exchange, can also influence cap rates. This makes cap rates a dynamic metric for evaluating real estate investments.

Why Do Investors Use Cap Rates?

According to Squires, cap rates became dominant in real estate over the past several decades as the sector was increasingly institutionalized.

"As real estate has become more of an institutional investment, we've seen the cap rate become the first question that anyone has when looking at a property," Squires said.

That's because a cap rate is simple to calculate and enables investors to easily compare properties across asset classes and geographies. More importantly, a cap rate will help an investor understand the perceived or potential risk of owning a property.

Of course, Squires advises that the notion of "risk" in this instance is entirely theoretical.

A cap rate is really a measurement of "the perceived risk" of owning a property, Squires noted; whereas "the actual risk is experienced while owning the property."

How Reliable Is a Cap Rate?

While useful, a cap rate isn't the sole metric to consider in real estate investment. It doesn't account for debt service or capital expenses. Squires advises caution regarding advertised cap rates, noting, "You could always estimate some cap rate; whether you believe it or not is another question."

Often, sellers use optimistic NOI figures, excluding management fees or using outdated tax figures. They may also underestimate vacancy loss, which varies by property type. "Credit loss is a bit of an art," says Squires, highlighting the variability from asset to asset.

Even properties advertised as triple-net (NNN) often carry some owner expenses. "It's quite rare for something to be an absolute NNN," Squires notes. Accurate NOI calculations should include vacancy loss, management fees, taxes, utilities, maintenance, administrative costs, and insurance.

Investors must perform due diligence to verify both income and expenses. Squires cautions, "A cap rate derived from faulty income or expenses is not an accurate measure." Cap rates are less reliable for properties with irregular income and don't account for future risks or market changes. They should be one of many tools used alongside other financial metrics and thorough market research.

How to Calculate Cap Rate

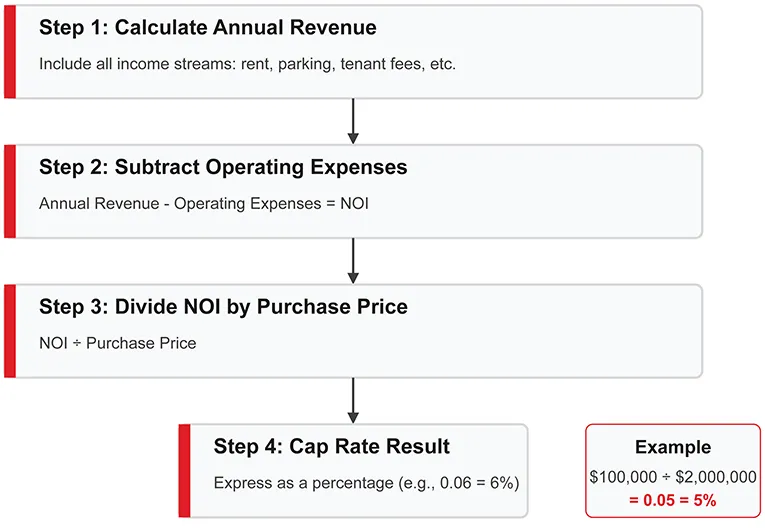

To calculate a cap rate, an investor needs to be in possession of at least two data points:

- The property's purchase price or market value

- The property's net operating income (NOI).

A property's NOI is established by starting with its annual revenue and subtracting annual expenses related to operating and managing the asset before debt service.

To determine the cap rate, an investor will divide the property's NOI by the purchase price of the asset, as reflected in the cap rate formula below.

Cap Rate Calculation Example

So, for example, if an investor was considering purchasing an industrial property for $2 million, and the property had an NOI of $100,000, you would divide $100,000 by $2 million, which results in .05, or a cap rate of 5%.

Cap Rate Calculation Flowchart

Including Occupancy Rates in Cap Rate Calculation

Considering the challenges of maintaining perfect occupancy, adjusting the NOI for occupancy rates can provide a more comprehensive analysis. The formula below accomplishes this:

(Annual Rental Income x Occupancy Rate) - Operating Expenses = Adjusted NOI

For example, if the property mentioned above has an occupancy rate of 90%, the adjusted NOI would be:

($100,000 x 0.90) = $90,000

Using this adjusted NOI, the cap rate would be:

By including occupancy rates in the calculation, investors can better understand the potential income variability and make more informed decisions.

Cap Rate Alternatives

| Metric | What It Measures | Best For | Limitations | Time Horizon |

|---|---|---|---|---|

| Cap Rate (Capitalization Rate) |

Property's income potential relative to its market value | Quick comparison across different property types | Ignores financing, future value changes, and capital expenses | 1 Year |

| Cash-on-Cash Return | Annual cash flow relative to actual cash invested | Leveraged investments; understanding actual return on equity | Ignores appreciation, loan paydown, and long-term value | 1 Year |

| IRR (Internal Rate of Return) |

Project's total return over time, accounting for time value of money | Long-term investments; comparing investments with different timelines | Complex to calculate; relies heavily on exit assumptions | 5-10 Years |

| Terminal Cap Rate (Exit Cap Rate) |

Projected cap rate at the time of property disposition | Projecting future sale value and exit strategies | Difficult to predict future market conditions accurately | Exit Year |

| Yield on Cost | Property's stabilized NOI relative to total development costs | Development projects and value-add opportunities | Doesn't factor in time value of money or stabilization period | Varies |

Note: Comprehensive investment analysis typically requires using multiple metrics for a complete evaluation.

Cash-on-Cash Return

For investors seeking deeper insights, a cash on cash yield can be an appealing alternative. This metric includes debt costs and capital improvement expenses, providing a clearer understanding of annual returns. Jonathan Squires notes, "A cash-on-cash return generally layers debt costs and capital improvement expenses into the calculation, which should give an investor a clearer understanding of the return they can anticipate from their investment each year."

Going-In and Terminal Cap Rates

Understanding the difference between the "going-in" cap rate and the "terminal" cap rate is crucial. The going-in cap rate uses the NOI from the year before acquisition, divided by the purchase price. For development projects, investors often compare this with yield on cost to determine if developing or acquiring is more profitable. Investors often hold properties for years, so they must estimate the terminal cap rate for the exit year, which projects the future sale price. A lower terminal cap rate compared to the going-in rate often indicates a profitable investment.

Internal Rate of Return

Cap rate gives you a snapshot of a property's income based on its current performance. In contrast, the internal rate of return shows how fast your investment grows over time. Using both metrics together helps you see both short term returns and long term growth. This combined view can lead to smarter investment decisions.

Price Per Square Foot

A basic yet effective technique is analyzing the price per square foot. This is calculated by dividing the purchase price by the property's size in square feet. Squires observes, "If a property has a low price per square foot, but also a low cap rate, it still could be attractive to an investor because they believe that the future value of the rents will be higher."

Comprehensive Analysis

Squires emphasizes the importance of using multiple metrics before purchasing a property. "Most investors will look at all these metrics and more before purchasing a property. It's important for investors to conduct their own analyses and not just rely on the information provided by the seller." Developing independent metrics allows for a thorough evaluation of potential investments.

Closing Thoughts

Understanding capitalization rates is essential in CRE investing. If you're ready to explore profitable opportunities, take the next step and browse our available commercial real estate properties for sale below.

Commercial Real Estate for Sale