West Virginia NNN Properties For Sale

There are 15 NNN Properties For Sale in West Virginia

- 1

- Harpers Ferry, WV NNN Properties For Sale

- Halltown, WV NNN Properties For Sale

- Charles Town, WV NNN Properties For Sale

- Ranson, WV NNN Properties For Sale

- Maidsville, WV NNN Properties For Sale

- Bunker Hill, WV NNN Properties For Sale

- Star City, WV NNN Properties For Sale

- Moundsville, WV NNN Properties For Sale

- Westover, WV NNN Properties For Sale

- Hundred, WV NNN Properties For Sale

- Chapmanville, WV NNN Properties For Sale

- Berkeley Springs, WV NNN Properties For Sale

- Paw Paw, WV NNN Properties For Sale

- Logan, WV NNN Properties For Sale

- Alum Creek, WV NNN Properties For Sale

- Morgantown, WV NNN Properties For Sale

- Smithfield, WV NNN Properties For Sale

- Nitro, WV NNN Properties For Sale

- Danville, WV NNN Properties For Sale

- Man, WV NNN Properties For Sale

- Dunbar, WV NNN Properties For Sale

- Bloomery, WV NNN Properties For Sale

- Saint Albans, WV NNN Properties For Sale

- Bruceton Mills, WV NNN Properties For Sale

- California NNN Properties For Sale

- Texas NNN Properties For Sale

- Florida NNN Properties For Sale

- New York NNN Properties For Sale

- Illinois NNN Properties For Sale

- Georgia NNN Properties For Sale

- Pennsylvania NNN Properties For Sale

- North Carolina NNN Properties For Sale

- New Jersey NNN Properties For Sale

- Ohio NNN Properties For Sale

- Michigan NNN Properties For Sale

- Virginia NNN Properties For Sale

- Massachusetts NNN Properties For Sale

- Colorado NNN Properties For Sale

- Washington NNN Properties For Sale

- Arizona NNN Properties For Sale

Learn More About Investing in NNN Properties

NNN Properties For Sale

What is a Triple Net (NNN) Property?

A Triple Net (NNN) property is a commercial real estate asset where the tenant is responsible for paying three primary expenses in addition to rent: property taxes, insurance, and maintenance. This lease structure is common in commercial real estate and provides unique benefits and considerations for both landlords and tenants. For a comprehensive explanation of Triple Net leases, you can refer to our detailed article: Understanding the Triple Net Lease.

What types of properties are typically offered as NNN investments?

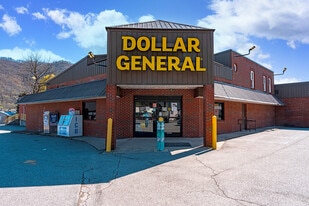

NNN properties for sale often include retail stores, fast-food restaurants, pharmacies, banks, and other commercial buildings. These properties are frequently occupied by national or regional tenants with strong credit ratings, making them attractive to investors seeking stable, long-term income streams.

What are the advantages of investing in NNN properties?

Investing in NNN properties offers several benefits: 1. Steady income: Long-term leases (often 10-25 years) provide consistent cash flow. 2. Low management responsibilities: Tenants handle most property expenses and maintenance. 3. Potential for appreciation: Property value may increase over time. 4. Tax benefits: Depreciation deductions can offset income for tax purposes. 5. Easier financing: Banks often view NNN properties as lower-risk investments.

What should I consider when evaluating NNN properties for sale?

When evaluating NNN properties, consider: 1. Tenant quality: Assess the financial strength and credit rating of the tenant. 2. Lease terms: Review the length of the lease, rent escalations, and renewal options. 3. Location: Evaluate the property's location and its potential for long-term value. 4. Building condition: Understand the age and state of the property, as major repairs could become your responsibility at lease end. 5. Market trends: Research the local real estate market and economic conditions.

How do NNN properties differ from other commercial real estate investments?

NNN properties differ from other commercial real estate investments in several ways: 1. Lower management involvement: Tenants handle most property expenses and maintenance. 2. Potentially lower returns: The trade-off for lower risk and management is often a lower initial yield. 3. Longer lease terms: NNN leases typically have longer durations than other commercial leases. 4. Single vs. multi-tenant: Many NNN properties are single-tenant, reducing diversification within a single property.

What are the potential risks of investing in NNN properties?

Potential risks of NNN property investments include: 1. Tenant default: If the sole tenant fails, income could cease entirely. 2. Property condition at lease end: Major repairs or renovations might be needed to re-lease the property. 3. Market changes: Long-term leases might not adjust quickly to market rate increases. 4. Limited diversification: Single-tenant properties concentrate risk. 5. Lease renewal risk: There's uncertainty about whether the tenant will renew at lease end.

How does financing work for NNN properties?

Financing for NNN properties often involves: 1. Lower down payments: Sometimes as low as 25-35% of the purchase price. 2. Longer loan terms: Often matching or nearly matching the lease term. 3. Non-recourse options: Some lenders offer non-recourse loans for qualified buyers and properties. 4. Competitive rates: Strong tenants and long-term leases can result in favorable interest rates. 5. Assumable mortgages: Some NNN properties come with assumable financing, which can be advantageous in high-interest-rate environments.

What's the difference between a NNN lease and a "bondable" or "absolute" NNN lease?

While a standard NNN lease makes the tenant responsible for most operating expenses, a "bondable" or "absolute" NNN lease goes further: 1. In a bondable lease, the tenant is responsible for all possible expenses, including structural repairs and replacements. 2. The landlord has no financial responsibility for the property during the lease term. 3. These leases are less common and typically only agreed to by large, creditworthy tenants. 4. They're called "bondable" because the landlord's position is similar to that of a bondholder – receiving steady payments with minimal risk or responsibility.

Please Share Your Feedback

We welcome any feedback on how we can improve LoopNet to better serve your needs.Create a New Folder

Removed from Favorites